2017 Real Estate Investment Outlook

Despite major events such as Brexit, the U.S. presidential election and, most recently, China's announcement that it is monitoring capital outflows, the real estate sector remains robust.

As 2016 comes to a close, global real estate services firm Jones Lang LaSalle (JLL) identifies trends to watch out for in Asia Pacific in the year ahead.

China Will Continue Overseas Investment

In the third quarter of 2016 China overtook the United States to become the largest cross-border real estate investor, having invested nearly $18 billion into commercial property assets internationally in the first three quarters of this year.

News broke in November that China is taking a more cautious stance to capital outflows, curbing overseas investments of more than US$10 billion and mergers and acquisitions valued at more than US$1 billion if they are not part of a company's core business. JLL predicts some short-term impact on the more high-profile deals, but if anything, it is going to gather momentum due to the enormous capital base in China."

Country opportunities

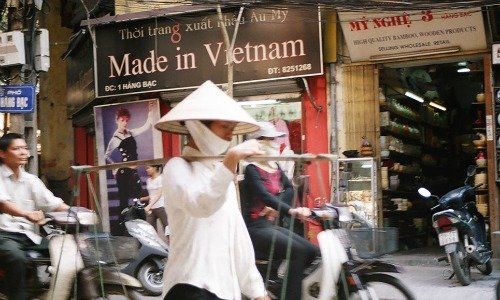

Investors are looking at Southeast Asia for 2017, in particular Vietnam. Its real estate sector saw a 12 percent year-on-year increase in investment. It is forecast to grow with favourable conditions such as greater market transparency and a projected GDP growth of about 6 percent, in keeping with growth rates this year.

Mature markets Australia and Singapore are still attractive. Investors like Australia because of its transparency and higher yields and for Singapore, in what has traditionally been a volatile market, investors are seeing the current entry point as an attractive one.

More and Bigger Deals

This year saw several significant highlights in terms of transactions: Qatar Investment Authority, buying Asia Square Tower 1, (pictured), Century Link complex in Shanghai's Pudong district being sold for $2.96 billion to Beijing-based insurance company China Life; and Brookfield Asset Management acquiring the International Finance Centre Seoul for $2.7 billion. There is every indication that this trend for big ticket deals will continue into 2017

The Post-Brexit and Trump Effect

The shocks of Brexit and the U.S. presidential election have not caused any significant changes in the real estate market in Asia Pacific, despite some short-term currency volatility.

Activity across Asia Pacific in the first nine months of the year was stable compared to the same period in 2015. Midyear saw capital flows to Europe slow down and outbound capital flow to the US. Following Brexit, there have been several big deals done by Asian investors in the UK, brushing off uncertainty.

With regards to President-elect Trump, there is some potential for stock market and currency volatility, as well as political risk due to geopolitical tensions. This may drive the world's largest investors to increase their allocations to the asset class because of real estate's safe haven nature and diversification benefits plus relatively higher returns.

«The outperformance of capital values compared with rents has pushed core yields to new lows in many markets across Asia Pacific, but the overall commercial real estate investment market should remain stable in 2017, as we expect continued institutional appetite for real estate in the region but an ongoing shortage of stock,» says Megan Walters, Head of Research, JLL, Asia Pacific.