OCBC Gets Barclays Boost

OCBC's private banking unit booked a strong increase in assets under management in part due to the acquisition of Barclays Asia.

Oversea-Chinese Banking Corporation Limited (OCBC) reported a net profit after tax of $973 million Singapore dollars for the first quarter of 2017, 23 percent higher than the previous quarter.

The robust year-on-year performance was largely driven by sustained growth in wealth management income, higher profit from insurance operations as well as increased earnings in local currency terms from all of the Group’s overseas banking subsidiaries, particularly from Indonesia.

Wealth Contribution Growing

Overall wealth management income, comprising income from insurance, private banking, asset management, stockbroking and other wealth management products, grew 50 percent to S$724 million Singapore dollars.

Wealth management contributed 32 percent, of the Group’s total income, compared with 23 percent for the same period in 2016.

Higher Fee Income

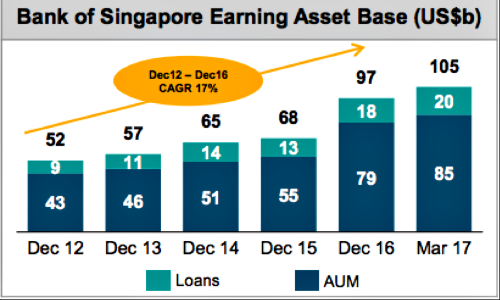

OCBC’s private banking business continued to grow, as reflected by a significant increase in assets under management to US$85 billion as at 31 March 2017, up 49 percent from the previous year, partly contributed by the acquisition of Barclays Wealth and Investment Management.

«We are pleased to report a rise in first quarter earnings. Our results reflect the underlying strength and diversity of our banking, wealth management and insurance franchise. We achieved broad-based loan growth, grew our private banking AUM, and reported significantly higher fee income,» said Samuel Tsien OCBC Chief Executive.