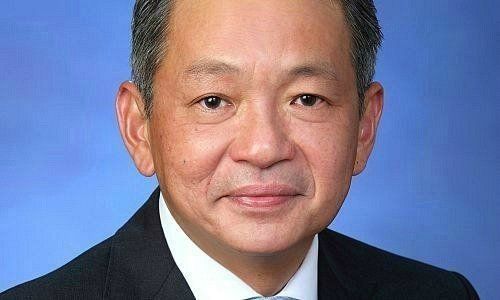

Jimmy Lee: «Watch This Space for Similar Deals»

The private bank with the most aggressive appetite for acquisitions has turned target in what could be a landmark deal with Nomura. It may not be the last such deal, Asia head Jimmy Lee tells finews.asia.

By Shruti Advani, Guest Contributor finews.asia

Nomura Holdings has taken a 40 percent stake in the Swiss private bank's wholly-owned subsidiary – Julius Baer Wealth Management Ltd. The unit services the Swiss bank’s high net worth client base in Japan.

Once the deal is done, the name will change to Julius Baer Nomura Wealth Management Ltd. Nomura will nominate its own representatives to Julius Baer's board in Switzerland. The deal highlights that the Swiss bank's appetite for mergers and acquisitions continues unabated, even after the departure of «deal guy» CEO Boris Collardi last year.

The deal could be a game-changer for Julius Baer not only because it will allow access to Nomura’s onshore network but also because it will unfetter Julius Baer staff from regulations that severely restrict what foreign banks can offer to domestic clients.

«Not In a Losing Position»

As Jimmy Lee, the Swiss firm's head in Asia and top executive responsible for the deal tells finews.asia exclusively, «Julius Baer relationship managers will now be able to talk to clients openly about their Swiss bank accounts in a sushi bar or kaiseki den.» Lee believes this, rather than the additional capital it will bring, is the most significant advantage of the deal.

«We have enough capital already but there is no such license granted to any other foreign institution and none of them can have a network better than Nomura’s in Japan,» he says, speaking from Zurich immediately after the bank’s announcement this morning.

Although neither bank will talk publicly about the value of the deal or Julius Baer’s onshore Japan franchise, Lee is happy to confirm that «Julius Baer is not entering [into it] at a losing position either.»

Cash For Stake

Nomura will pay Julius Baer Group Holdings in cash for the 40 percent stake and – crucially – the proceeds will not be redistributed to any other businesses but will «be focused on the P&L in Japan,» Lee says. It is in essence a doubling-down on the bank’s bet on the region.

«This strategic partnership focuses on a single product – bespoke discretionary mandate services,» explains Lee. He is counting on the bank’s 20-year track record with Japanese clients to be its calling card when tapping into Nomura’s client base in Japan.

An Ernst & Young report on the wealth management industry released earlier this year underscores the increasing importance of strong discretionary or advisory offerings to a private bank’s survival: «Most under pressure is the model of the traditional wealth manager, whose business is product-based. We see the long-term prospects of this model as being very limited, a switch to a truly client-centric advisory-oriented approach is more feasible than a diversification strategy,» it cautions.

«Watch This Space»

Under the terms of the deal, Japanese clients will be advised by Julius Baer’s portfolio management team in Zurich, with senior relationship managers from its own as well as the erstwhile Nomura team acting as the link. Nomura is expected to second its relationship managers to the new entity and Julius Baer does not foresee any redundancies as a consequence of the deal.

The partnership with Nomura is strikingly similar to Julius Baer’s strategy in other onshore markets such as Thailand where it announced a strategic alliance with Siam Commercial Bank in March this year. Lee does not deny the possibility of striking similar deals in other markets, particularly in Asia where most of the wealth continues to be onshore. «We are in several discussions but it is too early to comment. Watch this space.»