CapBridge Granted RMO Private Exchange License by MAS

Global private capital platform CapBridge has received approval from the Monetary Authority to operate a securities exchange known as 1exchange as a ‹Recognised Market Operator› in Singapore.

The 1X private exchange structure is according to a news release on Friday highly unique and designed to catalyse liquidity for private companies, prior to an exit event such as an IPO or an M&A situation. Companies listed on 1X remain private and enjoy more control, greater flexibility and lower costs as compared to a public listing.

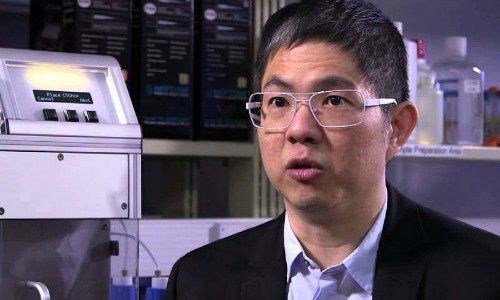

«With the RMO exchange license, we can now offer an even more integrated suite of private capital services to deserving companies seeking growth capital and sophisticated investors looking for alternative growth options,» Johnson Chen, (pictured above), founder and CEO of CapBridge, said.

Holistic Approach

Together, CapBridge and 1X will provide growth companies with a holistic private capital raising environment. These companies include private operating companies seeking capital, or preparing for liquidity events; late-state, venture-backed companies with shareholder and employees seeking to monetise their shareholdings; and family owned businesses seeking to diversify shareholder base or planning for management transitions.

The RMO license is effective from 21 November 2018.