The Odd Déjà-Vu with Credit Suisse

The similarity follows decades of differing paths for the two. While the much larger UBS, formerly Swiss Bank Corporation, is known as a bulkier and less moveable but very solid mass organized with military precision. Credit Suisse under long-time Chairman Rainer E. Gut was far nimbler, more entrepreneurial and more North American, thanks to ties harkening back to 1978 to leading Wall Street bank First Boston, or later CSFB.

Due to this Credit Suisse was far more wedded to (and better at) investment banking than UBS, which was burned repeatedly with the Long-Term Capital Management, or LTCM, hedge fund crisis and later its financial crisis losses. Instead, UBS became known as the leading corporate lender for Swiss firms. UBS also took over a host of Swiss banks in the 1960s and 1970s.

Chiasso and Subprime

In contrast, Credit Suisse was a nobler and more selective bank, preferred by Zurich's old monied families. This changed in 1977, when millions were laundered through a Credit Suisse branch in Ticino in what became known as the Chiasso scandal. The crisis left its mark on Credit Suisse, which nevertheless emerged as a more agile competitor to UBS. Later organized as a holding structure of various subsidies, Credit Suisse tried the «bancassurance» strategy in the 1990s (unsuccessfully).

Meanwhile, UBS followed a cookie-cutter approach and focused on traditional banking. When Credit Suisse got in over its head during the late 1990s new economy, UBS largely stayed on the sidelines – only to trip and fall during the 2008-09 financial crisis, when the bank had to be rescued by the Swiss government.

UBS-Like Turnaround

The restructuring of UBS which followed, orchestrated in large part by Ermotti, who has run the bank since 2011, is the template for the turnaround Thiam has just concluded over at Credit Suisse. Both have put business with wealthy clients at the heart of their strategy, and both have abandoned riskier investment banking and trading activities that soak up valuable capital.

Thiam is on record speaking admiringly of UBS' decisions. He does insist on a nuance though: Credit Suisse is an entrepreneur's bank that offers wealthy businesspeople wealth management as well as investment banking services (often at the same time).

As early as 2015, when Thiam took over, institutional investors griped that Switzerland didn't need «another UBS.» With Wednesday's investor day, Thiam has taken a step closer to the Ermotti-led bank. Both now pursue an arch-conservative philosophy of beguiling investors with share buybacks and dividend hikes.

Dim Outlook

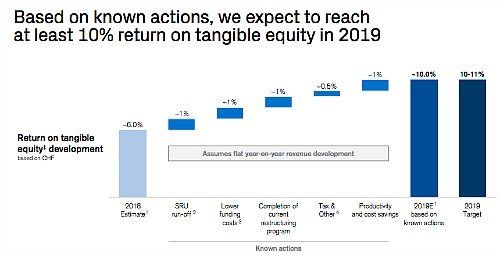

Credit Suisse wants to reach the improvements to its return on equity through cost-cutting – there is little mention of revenue growth (see graph).

Credit Suisse followed UBS in issuing a dull outlook. While the global economy is still growing, it is off earlier growth rates, CEO Thiam warned on Wednesday – meaning it will be harder for Credit Suisse to reap a revenue fillip.

Lack of Trust

The reaction of UBS and Credit Suisse's stocks illustrate that the two banks need to demonstrate more than spending cuts and shareholder goodies if they want to boost their shares sustainably. Consulting giant McKinsey, where Thiam spent a considerable part of his career, said banks are simply running idle in terms of revenue.

McKinsey blamed a lack of trust in the future of banking for investors apathy towards financial stocks. Investors are asking themselves if and how banks can break out of their anemic state and reinvent traditional banking.

- << Back

- Page 2 of 2