SFC Chief: «Sustainability Is More of a Science and Less of an Art»

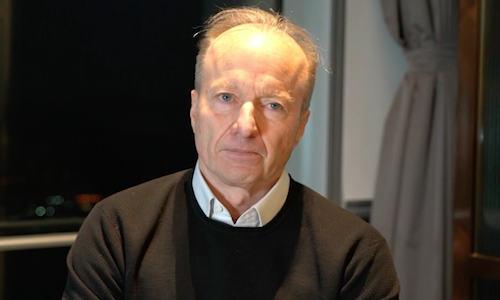

Hong Kong’s chief watchdog Ashley Alder called on the industry to make a more concerted effort to standardize processes and definitions in sustainable finance, highlighting China as the key factor behind success or failure.

According to the Securities and Futures Commission (SFC) chief executive, the industry still had ways to go before achieving «consistent, comparable and decision-useful disclosures from companies as well as from financial intermediaries» like asset managers – a critical prerequisite to help any investor compare and contrast investment decisions to improve global wellbeing on issues such as climate change.

«[R]ight now, we are still a long way from this goal,» Alder said at the Asian Financial Forum (AFF) 2021 in a virtual speech. «We have, instead, seen the development of a dizzying number of alternative sustainability disclosure frameworks. Many of these are strictly voluntary only or only set out high level principles which in some respects, can be conducive to green-washing.»

«Far from Straightforward»

Alder sympathized that this was no straightforward task for the industry and underlined that success for implementing practices to drive sustainability in Hong Kong’s financial sector was highly «data-dependent».

«At the most basic level, asset managers face major data challenges that certainly need to be tackled head-on over the coming months,» he acknowledged.

«The ultimate goal is to produce disclosures which reveal far more about what is being financed, especially the volume of [carbon emissions], whether investment portfolios are climate-aligned and how FM address climate risks.»

Real Economy Participation

Alder noted that the SFC was working both locally and internationally with its partners on how to facilitate sustainability-related decision-making processes such as the requirement for asset managers to calculate weighted carbon intensity at the fund level.

«These calculations are highly data-dependent, so the changes we propose will rely on the access to the right data as well as the reliability and comparability of that data,» he said, noting the limitations of financial services providers.

«it is important to recognize that this will ultimately depend on getting high quality information from the companies operating in the real economy where the TCFD recommendations also play a vital role.»

China Factor

Alder expressed great confidence in Hong Kong’s potential to be a leader in sustainable finance and highlighted China as the key factor behind its success in the next era of banking.

«Because of the extremely large footprint and international significance of Hong Kong’s financial market, we are uniquely situated to be a natural global leader in climate and environmental finance,» he explained.

«This follows from the fact that Hong Kong's vast capital market includes a huge swathe of China businesses. And it is universally acknowledged that solutions to climate change will depend in large part on successfully reducing emissions in China in line with its own national goals and the Paris Agreement.»

TCFD Compliance by 2025

- Page 1 of 2

- Next >>