Credit Suisse's Greensill Troubles Were One Year in the Making

Pressure from shareholders led Credit Suisse to reveal details related to the closure of funds jointly run with Greensill Capital.

In March 2021, Credit Suisse startled clients, investors and owners with bad news, the bank decided to close four funds jointly run with Australian-British financial firm Greensill Capital with over $10 billion in assets. But the problems started well before then.

As a chronic illness, Greensill continues to plague the bank. Following pressure from shareholders, Credit Suisse revealed in detail some of the events surrounding the debacle, releasing answers to a series of questions posed by the Ethos Foundation on Monday.

Shocking News

The answers provided by Credit Suisse revealed astonishing new details, particularly how badly it miscalculated the Greensill risks, despite all of its highly paid financial experts. Perhaps more shocking is the news that the Credit Suisse Supply Chain Funds were already in trouble at the beginning of 2020, and how early the Swiss Financial Market Supervisory Authority (Finma) knew of problems at the funds which they diligently promoted.

For The First Time

In March of 2020, the bank said one of the four Greensill funds, and a Virtuoso fund containing Greensill securities, experienced very high redemptions due to the Corona-induced stock market crash.

As investors tried to increase their cash holdings, they sold shares on a massive scale which included the two Credit Suisse vehicles. It was revealed for the first time that those funds were on the verge of closure at that point because they no longer had sufficient liquidity to make further payouts to redemption requests. Critically, the market for securitized loan financing in which the funds invested were illiquid due to Corona.

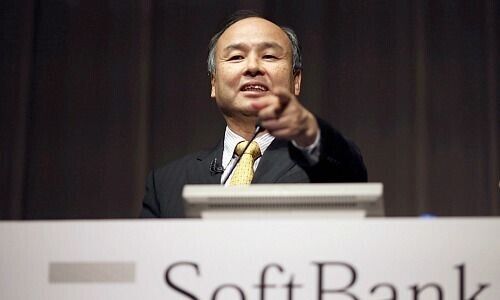

Enter Softbank

With its supply chain funds teetering on the brink of going bust and billions of client assets at stake, along with its reputation as a private bank, Credit Suisse entered into a disastrous deal.

Management of Credit Suisse Asset Management (CSAM) struck a deal with Japanese tech company Softbank, which was willing to invest $1.5 billion in the Virtuoso fund to keep it afloat. As part of the deal, Softbank CEO Masayoshi Son demanded bankers sign a separate letter in which supply chain funds would have to source loan paper only through Greensill Capital, which was a partner.

The problem with the letter was is that it violated the requirement that investors be treated equally. When Credit Suisse Group learned what was happening at CSAM, a law firm was hired to conduct an independent investigation.

Watchdog Alerted

At the same time, the investigation was initiated, and the issue was also reported to Finma, although the regulator was already aware of the problem at the supply chain funds at the start of 2020. Since then, Finma is conducting an investigation against the bank, which is still pending.

The letter with Softbank was canceled as a result, with the upshot being Softbank withdrawing the money again. For the time being, however, the funds that had been threatened with closure survived.

But the Group doubled down on its own fund business and demanded the funds reduce their investments in debtors related to Greensill. Because the securities were too illiquid at the time, Greensill couldn't meet demand in a timely manner, resulting in the decision by Credit Suisse to close the funds in March 2021.

The Fallout

Because of 2020's Softbank deal, Michel Degan, European and Swiss head of CSAM was sanctioned for his actions, with Credit Suisse definitively dismissing him in December of last year.

Last May, Credit Suisse cut all ties to Softbank and initiated legal action against it at the beginning of 2022. The bank accuses Son's company of having had its own agenda when refinancing Greensill and acting against the best interests of the fund investors.