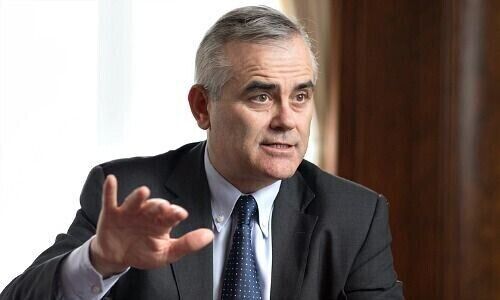

Credit Suisse has been reshuffling its management recently, and CEO Thomas Gottstein could be next.

The CEO of beleaguered Credit Suisse could be replaced as early as this year, according to a «Bloomberg» story (behind paywall) which cited people familiar with the matter.

Publicly, Gottstein still has the support of the board, but some are reported to be increasingly concerned that he is not getting the bank's problems under control.

To be sure, the first Swiss-born CEO of Switzerland's largest bank in almost two decades inherited a mess that included the Archegos collapse and Greensill. Detractors, however, say that the Archegos risks should have been managed better and been more alert to the Greensill problems.

Legal Woes

Class action lawsuits in the U.S. have been filed regarding Archegos-Greensill, and American plaintiffs have also targeted Credit Suisse management and business dealings with Russian oligarchs, the latter alleging it violated U.S. law.

While the wave of lawsuits is pouring in, the bank is also showing operational weakness. Earnings halved in the first quarter of 2022 compared to the previous year. The year 2021 had ended in a loss.

Management Reshuffle

Among the recent departures are CFO David Mathers who will leave the bank once his replacement is found, and general counsel Romeo Cerutti is also on his way out to be replaced by Markus Diethelm, who came from a rival UBS. Also stepping down is Helman Sitohang, who was in charge of Asia for Credit Suisse.

Former Bank of Ireland CEO Frances McDonagh has been appointed to head of EMEA, as finews.com reported.

In a statement, Credit Suisse that it would not comment on rumors and speculation, adding that «the Chairman clearly endorsed Thomas Gottstein. Nothing has changed in this regard», the story said.