Finma: Important Lessons to be Learned from Credit Suisse

Swiss Financial Market Supervisory Authority (Finma) published its annual resolution report for systemically important banks. Postfinance needs to go back to the drawing board.

Each year, the systemically important banks in Switzerland have to submit plans on how they can stabilize themselves in the event of a crisis. Contingency planning documents on which Wednesday's report from the Swiss Financial Market Supervisory Authority (Finma) is based were submitted around the middle of last year, well before UBS was forced to take over Credit Suisse.

Still, the regulator said important lessons could be learned from the crisis surrounding Credit Suisse, Finman said in the assessment.

«The events surrounding Credit Suisse show how important it is to make concrete preparations for crises. This meant that the authorities had options on the table with the restructuring plan and with the emergency plan that simply did not exist ten years ago. At the same time, it is clear that there are important lessons to be learned from the Credit Suisse crisis for future crisis preparations. Finma will contribute to this objective,» according to Finma CEO Urban Angehrn.

Bitter Irony

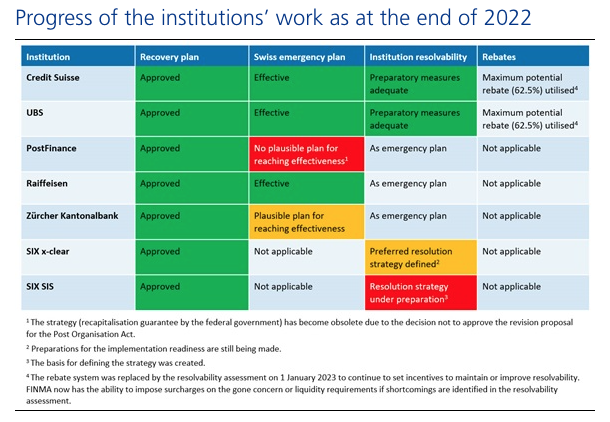

As the graphic below shows, Finma approved Credit Suisse's 2022 recovery plan and said its Swiss emergency plan was «effective» while the resolvability of the institution showed that preparatory measures were «adequate.» According to Finma recovery plan guidelines, «the systemically important institution sets out which measures it will use to ensure its stability on a sustainable basis in the event of a crisis and be able to continue its business activities without government intervention.» The irony is inescapable.

Outdated Figures

Postfinance CEO Hansruedi Koeng pre-emptively defended himself against Finma's assessment in an interview with «Finanz und Wirtschaft» (in German, behind paywall) yesterday. «Clearly, the negative assessment of the emergency plan is stirring up a lot of dust at the moment. That's why a differentiated view is important,» he said, adding «The judgment is somewhat outdated.»

Finma was referring to 2021 business figures at the end of 2022, he said. «At that time, there was a negative interest rate environment, and the interest rate turnaround came in mid-2022. Today, we're in a much better position, especially in terms of emergency hedging.»

(Source: Finma)

Emergency Planning

While the recovery plans for Credit Suisse, UBS, Postfinance, Raiffeisen, and Zuercher Kantonal Bank (ZKB) were all approved, emergency plans painted a different picture. Postfinance fared the worst with having «no plausible plan for reaching effectiveness,» in the view of Finma. Postfinance was told it has to realign its emergency recapitalization strategy following the decision not to approve the revision proposal for the Post Organisation Act. A lawsuit filed by Postfinance against higher capital requirements recently failed in Federal Administrative Court.

In the case of ZKB, Finma said its emergency plan is not yet ready to be implemented, since it hasn't reserved sufficient capital for recapitalization in a crisis. However, it has begun to build up the corresponding funds by issuing «bail-in» instruments.

A First for Raiffeisen

Finma said Raiffeisen's plans were up to snuff, which was a milestone for the bank.

«For the first time, Raiffeisen’s emergency plan meets the requirements for the uninterrupted continuation of systemically important functions if the bank were to be at risk of insolvency. Raiffeisen can provide sufficient capital to be recapitalized and continued in the event of a crisis,» Finma said.