UBS Asia Job Cuts Show What Switzerland Faces

It is a year since the government and regulators forced UBS to rescue Credit Suisse. The recent news of job cuts in Asia makes it very clear what could be just around the corner for the domestic financial hub, finews.asia believes.

UBS is cutting about 70 jobs in Asia, according to various media reports on Thursday. Most of the redundancies are taking place in Singapore and Hong Kong, something finews.asia also indicated yesterday.

The step also ostensibly affects the bank's core Global Wealth Management (GWM) business even though the number of employees has been growing steadily in that region since 2022. But as UBS reported in February, the Asia Pacific made significantly less money in the fourth quarter of last year. Pre-tax profit fell by 46 percent to $97 million compared to the same period a year earlier. At the same time, the cost-income ratio rose to 87.7 percent.

The Asian Imperative

That is in itself remarkable. Besides the US, Asia is a strategic growth market for the bank. Both regions are integral to its future financial success and key to its investment growth story with UBS making large investments in both markets in recent years. The results are there for everyone to see, particularly after integrating Credit Suisse's business. There is no other bank in Asia that has such a large wealth management business with such high levels of invested assets.

At the end of 2022, before the forced takeover of Credit Suisse, about 16,500 individuals worked at UBS in Asia Pacific. At the time, that was 22 percent of the group's entire workforce. According to finews.asia, it managed about $437 billion in client assets then.

A Strict Schedule

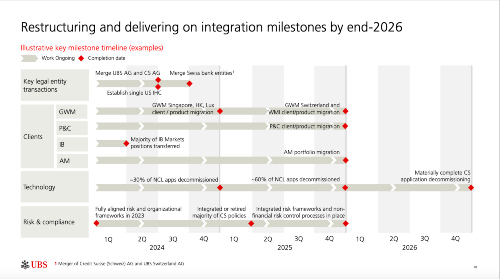

The current job cuts are likely due to plain economics. But they also have to be seen in the context of a wider restructuring. This has now started just about a year after the government and regulators forced UBS to take over its former rival and Switzerland's second-largest bank. That is also exactly what the bank announced in February (see image below).

Singapore, Hong Kong, and Luxembourg come first, followed by Switzerland afterward, an order of events that is expected to hold up over the next few years.

Branch Network Cuts Already Starting

We got a taste of that this year. In April, the bank will start consolidating its branch network with that of Credit Suisse's domestic business. About 85 branches belonging to both will be impacted by the consolidation. What is currently happening in Singapore and Hong Kong shows what can be expected in Switzerland very soon.

Moreover, when following the UBS schedule step-by-step, it is clear that the domestic market is to see very significant disruption.

Short Wait Times

The integration of the franchises of the country's two largest banks will change the financial hub sustainably and substantively. And it will be on a scale that we can't yet really imagine. With that, the fact that UBS's management is not wasting any time should be welcomed. The sooner the process is completed, the sooner the bank can concentrate on its actual job. Focusing on doing business with clients.

As part of that, it will be this exact core business experiencing the current round of cuts that will determine the success of its efforts to become a wealth management powerhouse - both in Asia and Switzerland.