These Banks Hold Most Money in Singapore Laundering Scandal

The final defendant in Singapore's largest money laundering case pleaded guilty last Friday. The confiscated billions of dollars are held at many prestigious banks.

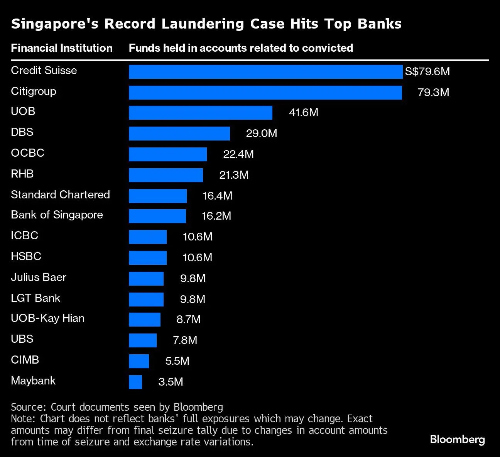

Swiss bank Credit Suisse – now owned by its rival UBS, and Citigroup held the largest amounts on deposit so far for the convicted, according to court filings reviewed by the news agency «Bloomberg» (article behind paywall). Others with significant exposure include the country’s three largest banks DBS, OCBC and UOB.

The China-born individuals and their close associates, together with companies they controlled, held more than $370 million in total at over a dozen financial institutions (see below).

(Source: Bloomberg, click to enlarge)

Many of these institutions also made significant loans that were not reflected in the seized assets. DBS for example, said previously it has about $100 million of exposure to the scandal, mainly from financing properties, «Bloomberg» reported.

Robust Checks

According to Singapore’s police force, there are 17 other people under investigation whose assets have been seized or frozen, whose tally is not included in these documents.

Spokespeople for banks that held assets of the launderers declined to comment. Citi said it is ensuring its staff to be informed of emerging risks and potential issues related to money laundering. UOB said it remains vigilant to money laundering risks and ensures that its due diligence checks are robust.