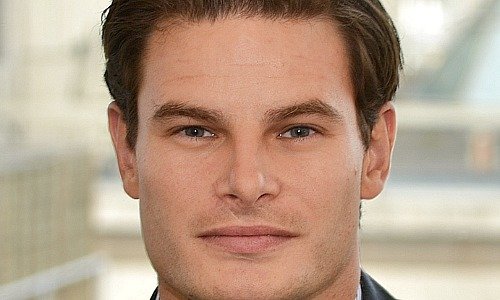

David Stubbs: «I Like the Idea of an Alliance of Finance Kings»

Switzerland's financial center may benefit from bloodletting in London's finance circles following Britain's decision to leave the European Union, leading city strategist David Stubbs told finews.asia.

Last week's decision by British voters to begin proceedings to leave the European Union potentially puts London on the same footing as Switzerland, which has never been a member and whose financial center has long grappled with access to the bloc from outside. That bodes well for Switzerland, a prominent strategist said.

«How can it not be a positive for Switzerland? You're a massive financial center, we're a massive financial center. We've just taken a gun and shot ourselves in the foot,» David Stubbs, global market strategist at J.P. Morgan's asset management division, told finews.asia in an interview.

Hedge Fund Moves

The comments by Stubbs, who warned of Brexit's dire consequences early on, highlight the frustration in London over the vote, which effectively emasculates the City as one of the world's centers of finance, alongside New York, Hong Kong and Singapore.

Switzerland has attempted to grab market share off London in the past, for example by attracting hedge funds to Geneva with tax breaks. While Swiss banks like Credit Suisse have moved staff out of London, it has been in favor of lower-cost locations within Europe, and not Switzerland.

The benefit of moving staff back to Switzerland is unclear: the country is extremely pricey due to a very strong currency, and doesn't have so-called «passporting», or market access to the bloc, because it isn't part of the EU.

Slow Bleed of Investment Banking «Guts»

In his first public comments since the vote, Stubbs said that London will lose out to Dublin – «the big winner» – as well as Paris and Frankfurt as thousands of jobs leave in the near term, while London will see a «slow bleed» of staff further out in favor of rival centers in Europe.

«I think there's going to be a quiet, slow migration. If you're a mid-sized organization and you have offices in London and Paris, where do you add headcount now, where do you add that incremental person or two?»

It is too early to parse the specifics – the «guts» – of what investment banking businesses are at the highest risk of leaving London and where they might go. Stubbs said that Switzerland might only see a modest benefit, but «it can't be a negative.»

Return of National Champions

For European banks which have unveiled dramatic restructuring measures in recent months like Deutsche Bank, Barclays, and Credit Suisse, the vote simply pours fuel on the fire, Stubbs said. The European banking sector has dropped nearly 20 percent since the result of the vote.

Deutsche and Credit Suisse are reinforcing their domestic businesses, which will come at the expense of London after voters decided to leave, he said.

«As a result of us (Britain) leaving the bloc and not controlling any of the rules, more of the business and flows stays in the Eurozone, then maybe these banks, these national champions, can start to benefit in a couple of years as economic activity shifts to Paris and Frankfurt, and is done by them and no longer London.»

Alpha vs Value Traps

That bright message belies a bleaker one for Europe's banks: there is a renewed urgency for ongoing reforms to address a drop in revenue as a result of the Brexit vote and its wide-ranging economic implications, which some experts predict will include a recession in the U.K. and a spillover into stagnant Europe.

But with bank stocks trading at a fraction of their book value, Stubbs says he sees opportunities in the sector following a shake-out.

«There is a lot of alpha. There's going to be some great buys, and there's going to be some companies that are value traps. That doesn't mean there aren't names in Europe that aren't good,» he said.

Swiss-British Alliance?

With the City of London facing the prospect of years of negotiations with the EU fraught with uncertainty for the financial sector, Switzerland – which has extensive experience fighting for its financial center in the bloc – could have lessons to impart to Britain, Stubbs said.

«I like the idea of us teaming up: the Swiss and the U.K., suited and booted walking to the European Commission as the alliance of finance kings.»