Cherry-Picking with Tidjane Thiam

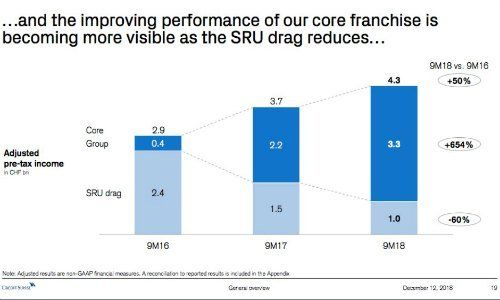

Particularly noticeable in marking the progress since October 2015, when Thiam unveiled the bank's restructuring strategy, is that comparison values have shifted. If Thiam usually references the year before his revamp as the base value, he refers back to 2016 when it comes to profits (Credit Suisse has yet to record a full-year profit under Thiam, but said earlier on Wednesday that it will for 2018).

A glance at the specifics reveals the reason: the bank recorded 1.8 billion Swiss francs (US$1.81 billion) in net profit in the first nine months of Thiam's first year, which is more than in the same period this year. The business Credit Suisse refers to as «strategic» looks even worse, though the comparison is difficult after three years of tough spending cuts.

Financial Wiles

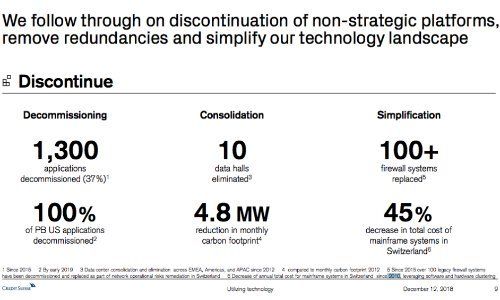

A further legacy area reveals another case of number-juggling: in information technology, or IT. Operating chief Pierre-Olivier Bouée requires six footnotes for exactly as many key figures.

The comparison figures range from 2010 to 2019. Next year, Credit Suisse plans to definitively dump the technological vestiges of its former North American private banking arm (which was offloaded to Wells Fargo more than three years ago).

This subterfuge likely doesn't help Credit Suisse at all: most people who look at the reams of slides don't do it for their health, meaning they are paying close attention. Overly optimistic depictions which don't stand up to closer scrutiny, or constantly-shifting benchmarks, only serve to aggravate investors. This translates to a general distrust of promises made by the bank's C-suite.

- << Back

- Page 2 of 2