Cherry-Picking with Tidjane Thiam

CEO Tidjane Thiam sees most of his turnaround targets at Credit Suisse as fulfilled. Gauging the exact progress of the bank since 2015 requires closer examination, finews.asia argues.

Tidjane Thiam called time on a three-year restructuring of Credit Suisse: the bank's CEO ticked off more than a dozen tasks as completed when he faced investors on Wednesday.

In future, he wants to be measured on one benchmark: returns. This will make it easier for investors and observers of the Swiss-based institute to differentiate between successes and misses.

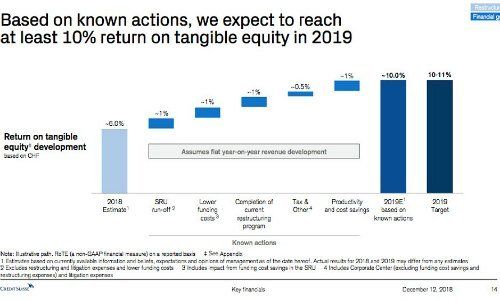

Finance chief David Mathers also showed how the bank wants to crack the 10 percent threshold for returns on its toughest form of capital. Conspicuously, Credit Suisse isn't factoring in revenue growth next year in this particular measure.

Instead, Mathers explained how the bank wants to cut spending over the next three years. A «bad bank,» or strategic resolution unit, is to be shuttered, pricey interest payments to Qatar on crisis-era instruments will fall away, and costs for restructuring and job cuts have also tapered.

Creative Comparisons

As solid as this seems, it lacks fizzle, as the initial shrug from Credit Suisse investors illustrated. In contrast, Credit Suisse let loose its creative side in a comprehensive slide show depicting its successes.

- Page 1 of 2

- Next >>