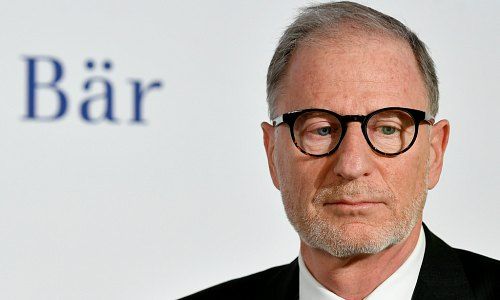

Julius Baer boss Bernhard Hodler is leaving his successor, Philipp Rickenbacher, growth and spending problems. Life is about to get rougher for the Swiss wealth manager's influential private bankers.

Monday, 9:30 a.m. in the gilt-trimmed banquet hall of Paradeplatz's Savoy Hotel adorned by gold damasque curtains, Julius Baer CEO Bernhard Hodler presents his last set of results. The Swiss private bank's «accidental» leader said he is pleased to be handing over the Zurich-based firm in good shape to his successor, Philipp Rickenbacher.

In fact, Julius Baer's profit and revenue after six months are down on the year. The bank's cost-income ratio swelled to 71 percent, Julius Baer's private bankers missed a net new money target, not least because of «problem child» Kairos in Italy.

One avenue Hodler sought to counter the drop is to slash 100 million Swiss francs ($101.8 million) in spending. Julius Baer will reap the benefits of this, he said, later this year and in 2020.

Touchy Banker Ranks

The problem? To save money, Julius Baer won't be able to spare its expensive – some would say pampered – cadre of private bankers. Hodler told journalists on Monday that the bank had hired 50 advisers so far this year in «focus» markets, and already signed contracts to poach roughly as many in the second half.

But ultimately, Julius Baer's nearly 1,500-person private banker ranks will thin on the year despite the copious hiring – because of the spending cuts. Hodler said he had tightened requirements for relationship managers. The bank is mindful, he noted, of hiring productive bankers, and of retaining funds when bankers are let go.

Tricky Inheritance

That's the tricky part of Hodler's plan: Julius Baer already missed its own target of at least four percent growth in net new money (it stood at 4.5 percent year-ago, then dropped to 3.8 percent in the second half, before the most recent tumble to 3.2 percent). Hodler laid the blame primarily with withdrawals following an abysmal fund performance from Karios.

Asia, Europe, and Latin America fared well, he said. Fewer private bankers would indicate less net new money – unless Julius Baer can show the higher-producing bankers are picking up the slack for those leaving the bank, and withdrawals don't spread. Hodler is optimistic; it falls to his heir, Rickenbacher, whose appointment Hodler played a key role in, to make it work.