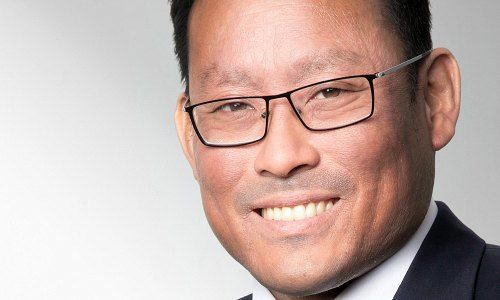

Daryl Liew: «Maybe Beijing Doesn't Mind What's Happening in Hong Kong»

It depends on which banks you are thinking of. If you are a client of an international bank, it is extremely easy to open a book and transfer your funds to Singapore from Hong Kong.

It is really the local banks that face problems. They are tied to the local economy. Of course, the business of the international banks in Hong Kong will be hit to a certain extent, but the impact on them will be much smaller.

How much of the banking business has already moved to Singapore?

People for sure are looking for alternatives. Anecdotal evidence has it that some people have opened new accounts in Singapore.

Both mainland Chinese and citizens of Hong Kong are looking to buy property in Singapore. Also, there are a lot of Singaporeans working in Hong Kong who want to move back.

«Expats are looking to move out of Hong Kong»

Singapore and Hong Kong are competitors and many services are offered in both places. With all the inconvenience in Hong Kong, expats are now looking to move out.

Don’t you think there might be a backlash against the protests over time because jobs are being threatened in Hong Kong?

That was the case during the umbrella protest. This time, however, is different. People have come to a breaking point and overwhelmingly support the protests.

What do you expect from markets going forward? They’ve been going really well this year so far.

The increases this year have been based purely on a multiple expansion. Earnings growth has been very weak or even negative. Earnings expectations are down 6 to 7 percent in Asia this year so far, instead of rising 10 percent as predicted a year ago.

Despite the shortfall in earnings expectations of almost 20 percent in Asia, stock markets added some 10 percent. Hence, most markets are now a lot more expensive than a year ago and priced to perfection. So if anything goes wrong, you might get a bit of a correction. It is not the time to be chasing risk assets!

Do you see any signs that things might look up though?

For further increases, we would need to see a recovery of corporate earnings. There are signs of that happening. The tech cycle may be bottoming out and it is looking a lot better for next year. 5G will be a huge driver for this recovery.

«Our outlook for Asia is quite positive»

For the banking sector however, it is very hard in the interest rate environment to earn money on the interest spreads.

So apart from banking, business in Asia is about to recover?

Our outlook for Asia is quite positive. The U.S. dollar has probably peaked and may move downwards, which is positive for Asia. Global growth is bottoming out and may start recovering.

I also expect a phase one trade deal to be signed between China and the U.S. in December – at least it looks as if there will be some kind of deal on the trade front. So Asia should do OK next year.

«It is not the right time to go bottom-fishing in the Hang Seng Index»

The question is whether this isn’t already priced in. On the other hand, markets in Asia have gained about 10 percent this year, which is much less than in the U.S.

Are there any markets in particular that investors should look out for?

The Chinese shares listed in China have outperformed Asian markets this year, while the Hong Kong-listed stocks of Chinese companies have lagged the market.

That’s because the Chinese shares in Hong Kong have been sold off by investors even though they have no greater business exposure in the city.

It may not be the right time to go bottom-fishing in the Hang Seng Index yet, because there is no visibility on when the problems in Hong Kong will be solved. But the Chinese companies listed in Hong Kong are worth watching out for.

Daryl Liew is the head of investment and portfolio management at Bank Reyl in Singapore. He, who has a Masters in Business Management from Asia Institute of Management previously worked for Providend in Singapore. At Reyl, he is a member of the investment committee.

- << Back

- Page 2 of 2