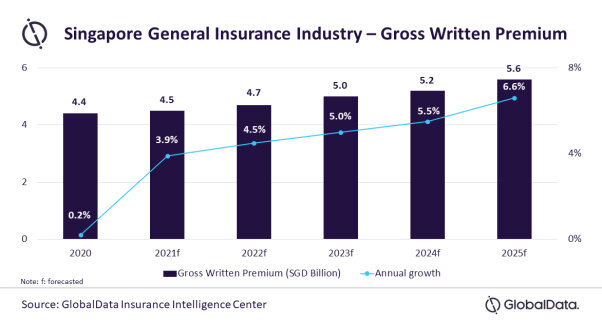

The general insurance industry in Singapore is expected to grow at a compound annual growth rate (CAGR) of 5 percent from S$4.4 billion ($3.2 billion) in 2020 to S$5.6 billion in 2025, in terms of gross written premium (GWP).

Resumption of economic activities, successful COVID-19 vaccination rollout programs, and relaxation on travel restrictions are expected to support the general insurance industry in Singapore, GlobalData said on Tuesday.

«The Singaporean economy is expected to pose a strong recovery in 2021 and grow by 7 percent following 5.4 percent decline in 2020. The general insurance industry is also expected to return to stable growth in 2021, after a flat growth of 0.2 percent in 2020,» Manogna Vangari, insurance analyst at GlobalData said.

Major Sectors to Recover

According to the analytics firm, motor insurance – the largest general insurance line in Singapore with a GWP share of 25.8 percent in 2020 – is expected to grow by 1.2 percent in 2021 after stagnating at 0.9 percent in 2020 due to lower vehicle sales and restrictive traffic movements. The 80 percent growth in electric vehicle sales is also expected to provide a boost.

Personal accident and health (PA&H) provided by general insurers is expected to grow by 3.4 percent in 2021, and 3.8 percent in 2022 on the back of demand for Integrated Shield plans, which cover private hospitals and specialist doctors. Property insurance is expected to grow by 7 percent in 2021, with higher construction output.