Credit Suisse: The Saudis Are Aboard

Following its extraordinary general meeting Wednesday, Credit Suisse is offering 889 million shares to existing investors and confirms Saudi National Bank stake of nearly ten percent.

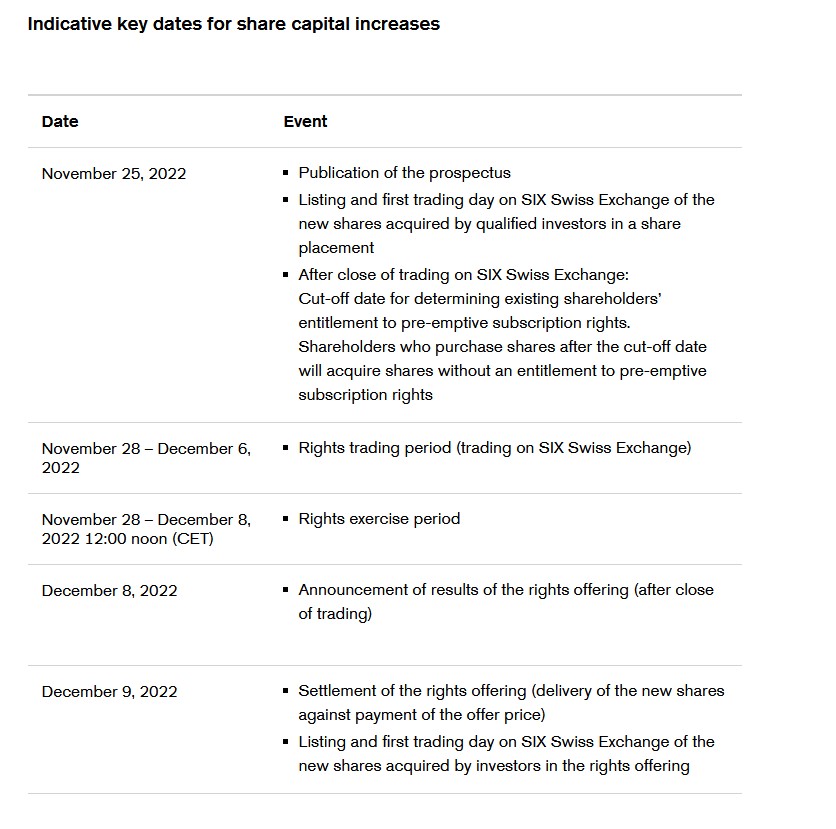

Existing investors have the opportunity to purchase 889,368,458 new shares of Credit Suisse at an offer price of 2.52 Swiss francs per share and raise 2.24 billion francs ($2.37 billion), Credit Suisse said in a statement Thursday, confirming the details of its 4 billion franc capital raise.

A further 462,041,884 shares were issued to qualified investors, with an agreed purchase price of 3.82 francs per share which is 94 percent of the 4.07 reference price resulting in gross proceeds of 1.76 billion francs. A total of 307,591,623 shares were issued to and purchased by the Saudi National Bank (SNB), giving it 9.9 percent of Credit Suisse.

The SNB and qualified investors committed to not selling the new shares they acquired until the settlement date of the subsequent rights offering at the very least and to exercise all rights allocated to purchased shares at the offering.

Together, the transactions raised 4 billion francs for the troubled bank which is expected to help boost its CET1 ratio and support its strategic transformation. As a result of the capital increase, Credit Suisse now has a nominal share capital of 124,511,584, an increase of 18,481,675 shares, an increase of just over 17 percent.