UBS: The Bulge Bracket Remains a Distant Dream

In the US, investment banking is seen as a door opener for the largest companies. New data shows that a combined Swiss UBS-Credit Suisse still has some way to get there.

Investment banking has become a stop-and-go business since the pandemic. Staring in 2020, lulls have been interspersed with hectic activity as markets wake up, resulting in the re-opening of blocked pipelines of deals that need working off.

Green Light

Right now, the traffic light is green for rainmakers, as experienced investment bankers are sometimes called. According to Dealogic, which produces the much-watched, influential industry league tables of the top-ranked banks, the classic investment banking business comprising the equity and debt capital markets (ECM/DCM) and merger and acquisition advisory (M&A) businesses booked $19.8 billion in fees in the first quarter of 2024.

In any case, that number is a good 11 percent higher than it was a year earlier.

Wallstreet Powerhouses

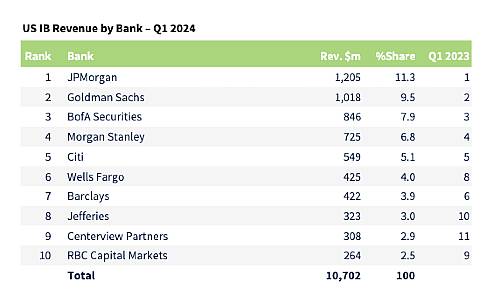

Europe and North Asia, which includes China, were among the most lucrative regions. But the banks raked in the most fees in North America, where they rose by almost a third to $11.6 billion. A glance at the league tables also shows that the major domestic US players on Wall Street pretty much divvied the entire business among themselves.

JP Morgan came first, followed by Goldman Sachs and the Bank of America (see graphic below).

(Graphic: Dealogic)

Their comparative home market advantage also catapulted them to the top of the global ranks. European players just barely made the top ten while UBS couldn't manage to eke out a position in the top ten in the US and globally. It only made fifth in North America when it came to private equity fees.

Structural Discrepancy

That will be a deep hit to the morale of the Swiss bank's leadership team.

(Image: UBS)

That is because UBS now owns a very established Wall Street business, albeit a scandal-prone one, after being forced to rescue Credit Suisse a bit more than a year ago. On top of that, UBS shrank its own investment banking business after the financial crisis in 2008, basically turning it into a delivery vehicle for its core wealth management business. That is something that still has a clear impact today. Even with the Credit Suisse business, its investment banking franchise is smaller than American and European competitors, as a snapshot view at the end of 2023 shows (see graphic below).

(Graphic: UBS)

A New Elite

Investment banking head Rob Karofsky (image above) wants to change that. He intends to become the leading alternative to the Wall Street powerhouses. According to him, he has to reach at least sixth place in the North American ranks for that to happen.

«Killer» Karofsky, as many call him because of his business sense as a market trader, has particularly ambitious strategic plans to expand the advisory and capital market businesses.

In the first quarter, however, the summit of the industry's largest dealmakers remained far out of reach despite media reports that seemingly indicate UBS has managed to integrate about 200 highly ranked Credit Suisse investment bankers, creating an elite unit to negotiate deals with the heads of the largest corporates.

Behind the Other Regions

Making substantial progress in the US investment banking market is critical as it is largely viewed as a door opener to the wealthiest entrepreneurs and their families. That is also where the true ambition of becoming a wealth management powerhouse lies. UBS wants to have a leading position in the US, the world's largest wealth management market.

But it is also exactly this region that the major Swiss bank has encountered difficulties for years. Growth in the wealth management business has remained under expectations for a long time now and the business in the US regularly posts the highest costs of all its regions worldwide. Last year, growth was the slowest in the US, behind that of Asia, Europe, and Switzerland, something that was also reflected in profit numbers.

Pre-tax profit in its American business was down by almost three-quarters in the fourth quarter of 2023, standing at only $102 million. In other words, UBS has a use for any and every strategic driver that it can find in that market. That will be a clear challenge for the investment bankers who are supposed to be opening the doors of the super-rich.