Although a bank's staff may be re-deployed to take on «digital ambassadors» or «advisory» roles, a bank's physical infrastructure, particularly bank branches, need to be revoked or re-invented.

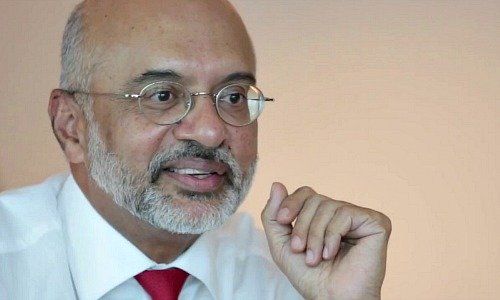

«The transition to digital payments is taking place so fast that authorities worry that it will become unviable for banks to maintain the infrastructure for handling cash,» Piyush Gupta, (pictured above) chief executive of DBS, said last month.

Banks Want to Keep Face Time

Banks in Singapore still believe that face-time and personal touch remain as important drivers for their wealth management and premier banking services. However, each bank has a different take on what to do with their branches.

«We don’t foresee the future of banking to be completely digital. The branches will still play a pivotal role as part of our multichannel offering. Customers still visit the branch as they crave for the face-to-face interaction that digital cannot provide», a spokesman for OCBC Bank said.

UOB’s stance concurs with that of OCBC's when it comes to maintaining existing branches, saying that they will not make big changes to existing bank branches.

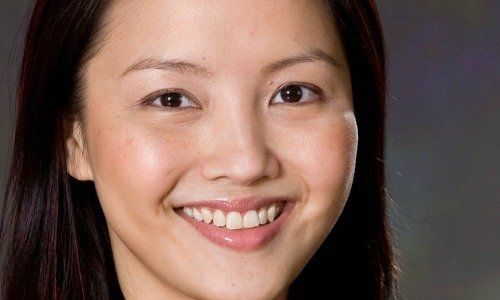

«We may see some network transformations, such as more machines at branches but we want to serve customers face to face, given the wide spectrum of customers we have» said Jacquelyn Tan (pictured above), head of personal financial services at UOB in Singapore.

DBS says it plans to to roll out more video teller-machines, or VTMs, over the next few years, given the initial success seen at its Plaza Singapura Branch. However, it looks ready to modify each branch according to its location and target customer segments.