1MDB: The Masterminds, the Swiss Bankers and the Hollywood Star

1MDB is a scandal that has it all: secret bank accounts, corrupt politicians, Swiss bankers, a Hollywood star and an army of investigators hunting them down. finews.com manual to a maze spanning the globe.

The Masterminds

Najib Razak, the prime minister of Malaysia, is one of the key figures behind the 1MDB scandal. He came up with the idea of creating a state fund, the Malaysian Development Berhad (1MDB), to further the development of the Asian country. Today, it seems clear that he and his second wife, Rosmah Mansor, used the fund to enrich themselves.

Razak amassed more than a billion dollars since taking office in 2009. He for instance had $681 million paid into his account via Switzerland's Falcon Private Bank (see «The Banks» further down).

The prime minister so far denies any wrongdoing and the Malaysian investigators cleared his name. That hasn’t stopped his involvement in the scandal from prompting a crisis of state. Razak’s wife is said to have spent millions of dollars on jewelry, shoes and fashionable clothes using credit cards issued to the 1MDB accounts.

Riza Aziz is the third member of the Razak clan deeply involved in the case. Aziz is a stepson of the prime minister. Millions of dollars from 1MDB were transferred to his accounts. His connections to Hollywood have added spice to an otherwise unsavoury soup (see video with his producer partner Joey MacFarland).

Aziz is said to have started his Red Granite film company using cash taken from 1MDB. He financed «Wolf of Wall Street» starring Leonardo DiCaprio (see «Supporting Act» further down). Film star and producer used to be close buddies and threw lavish parties.

Jho Low is a close friend of Aziz and one of the main characters of the drama unfolding. In 2009, before even turning 30, Low was named consultant of the fund. Low, a man of Chinese descent, started to make headlines as a keen socialite with seemingly unlimited funds available. Paris Hilton used to be part of his circle of friends.

Low celebrated his birthdays with Leonardo DiCaprio and gambled in the casinos of Las Vegas – and the Hollywood star made sure of thanking for his generosity.

Within the short space of a few years, the Chinese 1MDB-consultant spent hundreds of millions on art, luxury apartments in Manhattan and yachts. A self-proclaimed flamboyant investor, he also presented himself as the head of his company, Family Offices Jynwel Capital.

BSI, a Ticino-based Swiss private bank, was the bank of choice of Jho Low. Yak Yew Chee was his relationship manager (see «The Bankers» below). Low established several offshore companies with accounts at BSI.

Authorities around the globe are now investigating Jho Low's activities and numerous accounts have been frozen, his pieces of art and real estate seized. The man himself is said to be in Taiwan, where it is claimed that he is safe from extradition requests.

The web of mastermind also includes Khadem al-Qubaisi (pictured above, with former Falcon boss Eduardo Leemann), as well as Mohamed Badawy al-Husseiny, two influential former functionaries of the IPIC Abu Dhabi state fund and former board members of Falcon Bank.

The two are currently under arrest, facing charges for having taken proceeds from a 1MDB bond issue. Al-Qubaisi and al-Husseiny are also the ones to have initiated the transactions at Falcon Bank.

The Whistleblower

Xavier Justo, an IT-employee at Petrosaudi, kicked the ball into play. The man from Genevan descent stole data sets documenting the connections between the oil-producer and 1MDB and demanded money for his information.

It was the data provided by Justo, which documented the payment of $681 million through Falcon Bank to Najib Razak. Justo currently is in Thai custody for attempted blackmail.

The Bankers

Tim Leissner: a former colleague compared the Goldman Sachs to a hurricane: «He blew through really fast and did a lot.» That included a $3 billion bond deal for 1MDB, which is now being scrutinized by U.S. authorities.

Leissner, who is married to former model and designer Kimora Lee Simmons, was subpoenaed in February and, like many of the protagonists in the 1MDB saga, has kept a low profile since.

Hanspeter Brunner, Yak Yew Chee: Brunner’s move from Coutts to BSI in 2009 made headlines, partly because he took some 70 staff with him – an unprecedented raid on a rival. One of the private bankers to follow Brunner to BSI was Yak, reportedly Jho Low’s banker.

Brunner in March left BSI in great haste, citing retirement. Regulators have since shut down BSI’s branch in Singapore over 41 violations of money-laundering rules. Brunner, along with other former BSI bankers including Yak, are being criminally investigated in the city-state.

Eduardo Leemann: the banker is credited with rescuing AIG's private bank in Switzerland by finding Middle Eastern owners and founding Falcon Private Bank. Leemann has claimed that Falcon’s Abu Dhabi representatives opened doors, but never interfered in daily business – something which regulators claim is patently untrue.

As recently as March, Leemann said Falcon had done nothing wrong; by that time it had already flunked two regulatory inspections. Leemann retired quickly last month. Finma has opened enforcement proceedings against two former Falcon bankers; the bank won’t comment on whether Leemann is one of them.

Supporting Act

Hollywood actor and protege of Julius Baer Leonardo DiCaprio co-produced «The Wolf of Wall Street», which U.S. officials allege was partly financed by money pilfered from 1MDB.

DiCaprio publicly thanked his co-producers – none other than Jho Low and Riza Aziz – in an awards speech. A Swiss environmental group is publicly questioning whether DiCaprio took money pilfered by Low and Aziz for his own environmental charity too.

The 1MDB scandal’s global reach is not least due to a worldwide hunt for the masterminds behind the alleged graft. Switzerland, Singapore, the U.S. Malaysia, Hong Kong, Thailand, Australia, and Luxembourg all are pursuing the corruption allegations.

Swiss officials were substantially responsible that investigations into 1MDB didn’t fizzle. Prosecutor Michael Lauber froze $10 million on Swiss accounts last August, when he opened a criminal investigation into two 1MDB representatives.

He has since widened his investigation to BSI and two former high-ranking officials of Abu Dhabi’s sovereign wealth fund, as well as most recently Falcon Private Bank.

Finma director Mark Branson has been assertive in cracking down on Swiss banks ensnared in the corruption scandal. Together with Singapore’s Monetary Authority MAS, the Swiss regulator put Ticino-based BSI out of business and fined Falcon. Branson wants to begin naming and shaming individual bankers: ««It is individuals who commit offenses, not institutions,» he said recently.

Ravi Menon (pictured above), the head of MAS, is even more forceful: he revoked Singapore licenses for BSI and Falcon in a bid to patch up the city-state’s tarnished reputation. Finance often intersects with politics here: UBS, in which Singapore sovereign wealth fund GIC is the single largest shareholder, has come out of the scandal with «merely» a million-dollar fine.

{youtube}pIdUSnIV0vw/youtube}

The U.S. Department of Justice is also making sure that the upheaval won't simply fizzle, with Loretta Lynch as the political driving force. The DoJ has focused on the masterminds.

Bloggers at the «Sarawak Report» in 2015 published a comprehensive report about the flow of 1MDB funds from the Cayman Islands to accounts on an unidentified Swiss bank. One of its founders is Clare Rewcastle Brown (pictured above). The former journalist with the «BBC» and sister-in-law of Gordon Brown can lay claim to the unofficial title of «First Hunter» in the affaire.

The Loot

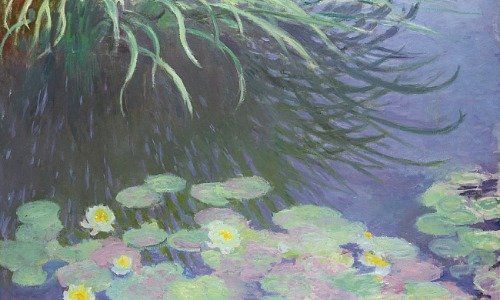

U.S. investigators in the summer estimated the loot to measure up to $3.5 billion, taken from the coffers of 1MDB. The latest figure made public was $4 billion. The U.S. alone has seized assets worth $1 billion, including real estate, a jet and pricey art (such as the Monet painting above). Some of the pieces of art were seized in the Geneva freeport.