Fintech no doubt is the flavor of the day in financial markets across the globe and Switzerland is no exception, being a hub for a vibrant startup community. But the high point may already be behind us.

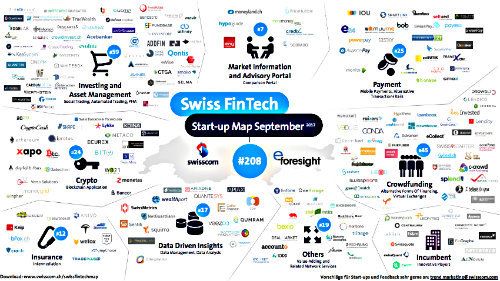

Switzerland is one of the major global fintech centers and the industry is booming: Swisscom counted fewer than a hundred fintech startups in 2015, today there are 208 companies active in wealth management, comparative consulting, crypto finance, data management, payment services and lending (see illustration below).

The industry is expanding and attracting investments. It has launched products and built its customer base. In short: fintech has found its place in the Swiss financial market. In other countries, such as Germany, Singapore or the U.K., the integration into the traditional financial market may be stronger though.

Blurred Dividing Line

And this may also spell the end of fintech as we know it, in Switzerland, and abroad. That’s at least what Armands Broks (pictured below) believes. The founder and CEO of Twino, a peer-to-peer lending platform, thinks that the fine line between finance industry and fintech is about to be blurred and that fintech eventually will disappear.

The reason for this development is the need for fintechs to cooperate with the financial industry players to establish themselves on the market, to grow, build a customer base and expand across country borders. The development requires a more stringent regulation with a need to harmonize with the financial market and that in turn forces fintech to get even closer to the industry.

The only way forward for fintech is through cooperation agreements and in doing so, «the fintech industry is signing its own death sentence,» Broks said. Exponents of the Swiss fintech industry may not concur with this image of a dramatic change, but the signs are on the wall.

Partnership the Only Way Forward

Over the past two years, fintech has evolved from being a potential and yet unpredictable danger for the banking industry to being part of the mainstream. PWC consultants said that about 60 percent of Swiss banks have links to fintechs. Four out of five banks are eyeing partnerships in the near future or are planning to expand existing ones.

UBS and Credit Suisse both entertain their own fintech laboratories, while Zuercher Kantonalbank is part of a blockchain group. Others, such as Postfinance and Basellandschaftliche Kantonalbank (BLKB) have bought stakes in fintech startups.

Hypothekarbank Lenzburg with its open banking interface attracted a string of fintechs, which offer their services to the bank’s customers.

Regulation a Major Catalyzer

The solutions found by banks to deal with the challenges posed by fintech show that the erstwhile rivals have joined forces. Regulation is a major catalyzer for this development.

Startups have plenty of leeway to develop their ideas as long as they remain in the proverbial «sandbox». Once their idea turns into a viable business, regulatory requirements kick in and the need to cooperate with established companies rises. They have the necessary know-how, capacities and experience to deal with the questions that arise.

Reaching the Critical Mass

A second major problem facing fintechs is the development of a customer base that makes the business worthwhile. Truewealth, an online wealth manager, had to agree to a deal with BLKB to get even close to the critical mass. At Descartes Finance, another Swiss robo-adviser, cooperating with established asset managers is part of the business model.

Additiv, a fintech developer, targets customers in the financial market and has recently attracted a well-known investor to help them finance their international expansion: Martin Ebner.

Millions Spent on Expansion

But most fintechs don’t have such potent backing. Advanon for instance plans to spend millions on an expansion in Germany and other European countries. Knip, a Swiss insurtech, spent millions of francs on trying to establish itself in Germany before being bought by a Dutch software company.

In any emerging industry, a large percentage of startups is bound to fold or be swallowed by larger firms. The dividing lines between finance and fintech will get blurred, as Broks says, and a new sector will emerge with new standards.