Credit Suisse Faces Third Net Loss

Credit Suisse said that tax reforms in the U.S. will knock 2.3 billion francs off its quarterly profit. The hit is likely to push the Swiss bank to its third consecutive annual loss.

The Zurich-based bank surprised investors late on Friday evening, a full two days after U.S. lawmakers passed a tax reform bill. The bank said it will have to book 2.3 billion Swiss francs in write-downs against the current quarter.

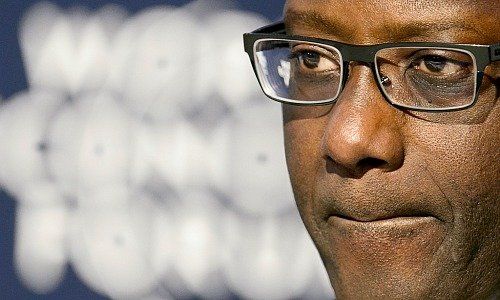

The move is a setback as Credit Suisse boss Tidjane Thiam faces an activist hedge fund's call to split up Credit Suisse, nearing the end of a gruelling three-year restructuring of the bank. Instead of taking in the investor approval for his three-year effort, the French-Ivorian CEO is likely to conclude the year and head into bonus season nursing the bank's third consecutive annual net loss.

Why the massive write-down? Trump's reforms do away with crisis-era tax credits that banks have been drawing on since the financial crisis of 2008/09. American rivals Bank of America and Citigroup have also revealed fourth-quarter write-downs as a result of the legislation.

Irking Investors

The bank disclosed the news after President Donald Trump signed the bill into law – a mere formality – late on a Friday evening which kicks off the U.S.' and Europe's biggest holiday. Thiam has had to replenish the bank's its thin capital by tapping shareholders twice. As a result, the bank has promised to pay shareholders a greater proportion of its profits, and in cash as opposed to shares.

Those payouts aren't in jeopardy, the bank said. «The policy for returning capital to shareholders announced at the [November] investor day is unchanged.» Then, Thiam pledged to hike returns to shareholders, and pay more than half of its net profit back to investors through dividends or stock buybacks.

UBS last year forecast its vulnerability to the reforms at 200 million Swiss francs per percentage point that corporate taxes are cut in the U.S. The new rate, 21 percent, is 14 points lower than the current one, which would put UBS' write-down at 2.8 billion francs. A spokesman for that bank didn't comment on the amount of the write-down.

Minimal Capital Dent

The bank said the write-down represents a singular accounting fluke, and will only «minimally» hamper its capital, which stood at a healthier 13.2 percent in the third quarter.

The billion-franc hit aside, Credit Suisse said the U.S. reforms are likely to bolster profits at its investment bank in the U.S., especially in advising companies and underwriting stock and bond issues, because they are expected to boost the American economy.

The bank pledged to give investors more information on the effect of the reforms on its business on February 14, when it reports the quarter, including the year's planned dividend or other shareholder payout.