The world's largest private bank doesn't want the wealthy to deposit any more money. Why is UBS definitively ditching one of the key feeders of future business?

The Zurich-based bank on Tuesday made it official: it doesn't want the wealthy to keep making deposits. It is also ditching net new money from its targets for its $2.6 trillion wealth management arm, now run by ex-Credit Suisse top banker Iqbal Khan and U.S. veteran Tom Naratil.

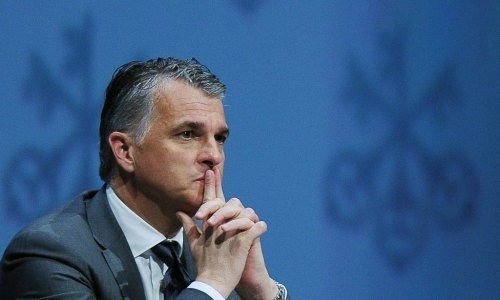

«It doesn't mean that its [net new money] not important. But overemphasizing net new money as an indicator of growth is a fatal mistake,» UBS CEO Sergio Ermotti (pictured below; Image: Keystone) said on Tuesday following a lower-than-expected result for the quarter. Until now, the unit targeted growth of between two and four percent against its existing pile of assets.

Program Outlined

The problem isn't new: UBS has been grappling with its wealthy clients' preference for cash for years. The stockpiles cost UBS millions every month because Switzerland's central bank levies charges on Swiss franc cash holdings to dissuade investors from the haven currency.

But the countermeasure is new: the Swiss wealth manager is renewing its push to get its rich clientele out of cash – and is willing to let them go if they resist. UBS is currently fine-tuning a program designed to get clients investing – and generating fees.

Pricing Impetus

If the clients don't bite, UBS will «look to price those clients,» finance chief Kirt Gardner (pictured below) said on Tuesday. This generally means hiking fees – in this case charges on franc deposits – to a level that hurts.

«If they decide that that's not the appropriate action for them, it's possible they might take their cash elsewhere,» Gardner said. «That of course, in turn, would have an impact on our net new money,» he noted.

Get Moving – Or Out

It is tantamount to a warning to clients to get moving – or head out. In short, despite client angst remaining high, assets under management are only «good» if they are either managed at the bank’s discretion or the bank is granted a mandate to invest. Gardner and Ermotti said UBS would detail the program in April when it reports results for the first three months of this year.

The Swiss lender was among the first to impose franc charges, something most wealth managers have adopted in order to soften the blow from the negative interest rates. The «anti-growth» problem first surfaced in 2016, when UBS attempted to dissuade clients from depositing idle funds.