Credit Suisse Inches Closer to Blackrock

Credit Suisse and Blackrock are teaming up again, according to information obtained by finews.asia. The big bank and the world's largest asset manager need each other more than ever.

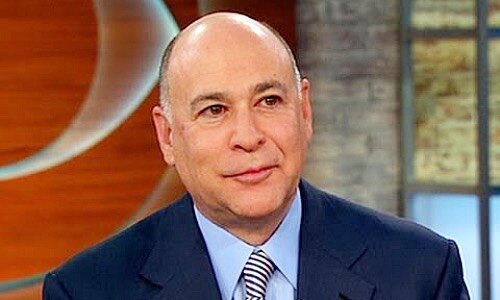

Lydie Hudson (pictured below) and Rob Kapito (pictured further below) are the latest pairing in the decades-old relationship between Credit Suisse (CS) and Blackrock.

She, the head of the Swiss big bank's sustainability and products division, and he, the co-founder of the world's largest asset manager, are joining hands for a new collaboration.

As finews.asia has learned from people familiar with the matter, CS and the American fund giant want to jointly build and distribute sustainable financial products. CS confirmed this to finews.asia.

Another Super Trend

According to the memorandum, the cooperation that has lasted for three decades is thus entering a new phase. Indeed, Switzerland's second-largest bank and Blackrock share a history of business and, not least, personnel overlaps. They helped each other out in the past – and will probably be even more dependent on each other in the future.

Although the details of the collaboration are not yet clear, the focus is on exclusive private market investments that are also subject to sustainability standards. The vehicles are part of CS's «supertrends» strategies – thematic funds with which the bank bets on demographics, infrastructure, or «inclusive» capitalism, for example.

Billion-Dollar Deal With ETF

The two partner firms don't have to get to know each other to do this. Together, they have already made billions, to the satisfaction of both parties. The sale of the CS index fund business to the Americans is still considered a milestone in the history of the Swiss fund industry – in 2013, the big bank sold 58 exchange-traded index funds (ETFs) with assets under management of about 16 billion francs to the world's largest asset manager.

Blackrock thus rose to become the most important foreign fund house in Switzerland, which the giant later underscored with a residence on Zurich's noble Bahnhofstrasse. Sensibly, CS then returned – on its own initiative – to the booming business with ETFs a year ago.

(Image: Youtube)

Fit for Platform Finance

Meanwhile, the big bank's asset management arm (CSAM) is working more closely than ever with U.S. giant Blackrock, which is also one of the bank's seven largest shareholders with a 4 percent stake in its share capital.

As a result, at the beginning of 2019, the Swiss kicked off the deployment of Aladdin, Blackrock's almost fabled technology platform that allows the Americans to manage risk for around 10 percent of all global assets and thus exert a decisive influence on financial markets.

By using Blackrock's technology, CS hopes to digitize its fund business thoroughly and make it fit for platform finance. Together, they are moving into the future – and keeping the past in favorable memory.

Career Start at First Boston

That's probably how Laurence «Larry» Fink, Blackrock's longtime CEO, feels. Before he co-founded the fund house in 1988 and led it to market leadership, he had gained experience as a banker: Fink began his professional career in 1976 at First Boston, the investment bank that was later taken over by CS and for a time was still part of the group name «CSFB».

On the other hand, various CS executives found employment at Blackrock. For example, former CS investment banker David Blumer built up the business with alternative investments at the American asset manager and worked there from 2013 as regional head for Europe, the Middle East and Africa (Emea), before he stepped down from the fund giant in 2019 as part of a revirement.

Preaching Water?

Former Blackrock Switzerland managers such as Martin Gut and Frank Rosenschon also previously had careers at CS, while former Blackrock cadre Christian Gast temporarily led quant startup Simag, in which the big bank, in turn, had a stake.

Here and now, ex-First Boston banker Fink can put CS's sustainability expertise to good use. The world's most powerful asset management CEO, who every year sends a letter to company bosses to clear their consciences, has himself become the target of criticism. Because: not everything in the Americans' display is as sustainable and responsible as Blackrock likes to demand of other companies. «Is Larry Fink preaching water, but drinking wine?», was the recent verdict of finews.asia.

Asset Management Realignment

Meanwhile, a further deepening of the partnership is also likely to suit the major Swiss bank. This is not only because of the sustainability goals that the bank's CEO Thomas Gottstein reformulated last year.

In asset management, the signs are pointing to partnerships – in the race for volume and thus economies of scale, even major players such as the U.S. fund firm State Street are now looking around for partners. It may well come in handy for CS to have the number one in the business next to it.