Small Swiss private banks suffered a net outflow of funds in 2020 for the first time in five years, with a PwC study suggesting continued pressure and a wave of consolidation in the near future.

The private banking sector was hit by the COVID-19 pandemic in 2020. But a fast market recovery from the initial shock of the pandemic nevertheless helped them to grow assets under management levels by 2.8 percent, helping them in comparison with other, more heavily impacted sectors.

That is one of the key findings from the new PwC Switzerland «Private Banking Market Update 2021». But the report also shows the contrasting fortunes between small and large.

Small Banks Suffer

The sector managed to eke out net new money growth of 3.1 percent last year, the highest pace is seen in a decade, even though business trips and face-to-face client meetings ground to a complete halt. The larger banks managed a strong turnaround, going from rates of minus 1.1 percent to plus 3.4 percent over a five-year period. Part of that is due to their global presence, particularly in the growing markets of Latin America and the Mideast. It is also due to their perceived financial strength and stability in times of crisis.

The large banks also have more technological resources and are better able to react to changing conditions. These same reasons are also why smaller banks in 2020 reported net new money outflows of 2.8 percent, with PwC expecting the trend to continue.

Margin Pressure

«We believe that net commission income in the next few years will fall because of the tough competition in the Swiss banking sector and that net interest margins will remain at their current low levels», said Martin Schilling, Head Asset & Wealth Management and Deals at PwC Switzerland.

Margin pressures in private banking put the entire finance sector under pressure, which lead to a record low operating margin of 82 basis points in 2020. Low net interest income had a clearly negative impact on the denominator of the industry's widely watched cost-income ratio, which rose to 85 percent, much of it borne by the larger banks.

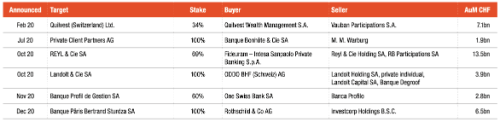

Six Transactions

As managed private banking client investments aren't held on the balance sheets, the private banks have lower levels of risk-weighted assets, which leads to higher rates of return on regulatory equity. While large and medium-sized banks continue to cover their capital costs, the smaller banks are constantly destroying shareholder value.

As a result, the pressure to consolidate will continue to increase although M&A activity in the entire private banking sector slowed last year. There were six transactions (see below), mainly with medium-sized banks having over $2.2 billion in capital. Smaller banks are expected to be at the fore in the future given the strong, continued earning pressure they face.

(Click to enlarge the chart)

About the Report

The «Private Banking Market Update 2021» was compiled by PwC Switzerland for the eighth time. The report encompassed 82 private banks in Switzerland, six completed M&A transactions and 75 key performance indicators (KPIs). It pools data from the past 16 years, providing a current picture of developments and trends in the sector.