Where Are Credit Suisse Clients Moving Their Assets?

What a difference a year makes. After many wealth managers saw record new money inflows and assets under management grow to new heights in 2021, last year proved to be a very different story.

Much has been written about how the war in Ukraine, rising interest rates, and financial market turmoil pummelled the assets under the management of Switzerland’s wealth managers. Add to that the ongoing drama surrounding Credit Suisse with clients withdrawing eye-popping sums from the bank, and it was another year for the history books.

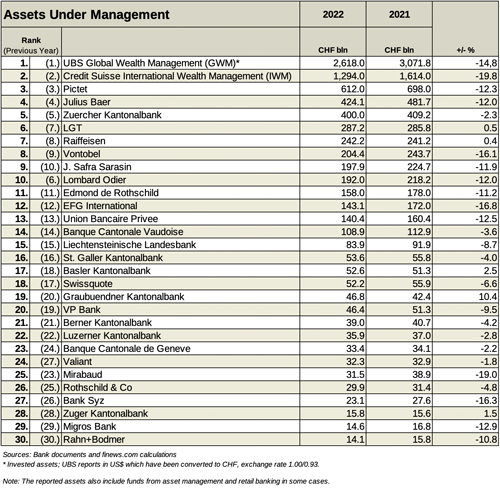

Except for LGT and Raiffeisen which saw comparatively modest increases in their managed assets, the major wealth managers such as UBS, Credit Suisse, Pictet, Julius Baer, Zurcher Kantonalbank, and Vontobel all reported double-digit declines in percentage terms.

In its semi-annual league table for the industry (see below), finews.com shows how they fared last year compared to the prior year which was, for many, a record year in terms of assets under management (AuM) and attracting new money.

Signs of Improvement?

There are some nascent signs the environment is becoming more favorable. On Friday, EFG International reported a modest rise in AuM to about 145 billion from 143.1 at the end of last year. In the early part of the year asset inflows were subdued due to the economic environment, turmoil in the global banking sector, and volatile financial markets, it said. But an encouraging sign emerged when EFG's asset inflows accelerated in March and April, with net new assets flow expected to improve gradually and return «to a more normalized level» in the coming months, according to an update to its first-quarter business.

Zurich-based Vontobel also reported an increase in net new money of 1.8 billion Swiss francs ($2 billion) for the first three months of the year and an increase in its AuM. Determining an industry trend from limited data is difficult, but it offers glimmering hope that this year will be better for the industry than the last one.

Resilient Cantonal Banks

Another picture that emerged was that a number of the Cantonal banks experienced a much smaller decline in their AuM base and, in some cases managed to improve over the previous year. This is perhaps due to their structure of state ownership, with investors seeing them as a safe harbor in turbulent times

The decline isn't just problematic for individual wealth managers, but also for the industry as a whole, because the erosion of the AuM base translates directly into lower overall fee income. There is a bright spot, however. The Swiss National Bank exited its policy of negative interest rates last year, so now the banks will not be charged interest on the deposits they have with the SNB, which will at least help their bottom line.

While that is some consolation, it doesn't make up for the lucrative business of managing wealth. One of the best ways to generate more fees is by expanding the AuM base with the time-honored way of attracting new money.

All Eyes on Credit Suisse

In October, Credit Suisse experienced what was nothing less than a «bank run» in the words of Swiss Financial Market Supervisory Authority (Finma) chair Marlene Amstad.

Credit Suisse clients pulled over 123 billion francs of assets from the institution last year, a sobering turnaround from the 30.9 billion they entrusted to it the year before. Credit Suisse said 110 billion of those outflows came in the fourth quarter, a figure Amstad put at a significantly higher 138 billion.

And that was just the end of last year. According to Amstad, in mid-March Credit Suisse experienced outflows of a magnitude similar to those in the fourth quarter, especially in its home market of Switzerland, which was the final straw for the viability of the bank.

With the government-forced takeover of Credit Suisse by UBS on March 19, the 1.3 trillion francs of assets under management at Credit Suisse is something that UBS will want to keep in its fold. While most are not coming out and saying so, other wealth managers are circling aiming for a slice of that pie. On Friday, EFG International said it had hired or made offers to around 50 client relationship officers. Coincidence?

New Money Flows

So where did those assets wind up?

The biggest wealth managers, save Credit Suisse and Vontobel, attracted net new money last year. While none of those institutions attribute inflow amounts to former Credit Suisse clients, some simple arithmetic gives some clues.

The top ten banks on the list, excluding Credit Suisse, attracted 125.9 billion Swiss francs of new money last year, with only Vontobel experiencing net outflows.

Topping the list for 2022 was UBS which saw 55.5 billion Swiss francs of new money coming to the bank, but that was no improvement over the 121.5 billion in 2021. In terms of improvement, Zuercher Kantonal Bank was the clear winner. The state-owned bank which attracted 25.9 billion in 2021, had 33.9 billion more of new client money to manage last year.

Chasing the Money

With the Credit Suisse and UBS tie-up, there are lots of overlapping investments which is also a reason why clients might be taking their money out of Credit Suisse and investing it elsewhere. That is a trend that is likely to continue. Most wealth managers are unlikely to brazenly come out and say they are going after Credit Suisse clients.

The closest one has come to doing so is Julius Baer. Recently CEO Philipp Rickenbacher said his firm was having «constructive discussions» with relationship managers seeking to leave Credit Suisse after its takeover by UBS. It doesn't strain the imagination those relationship managers were brought aboard with clients and their assets.

Chairman Romeo Lacher let the cat out of the bag over the firm's ambitions, recently saying Julius Baer can manage one trillion Swiss francs of assets by 2030. That is more than double the 424.1 billion it had under discretionary management at the end of last year.

Billions Up for Grabs

Credit Suisse will likely lose about one-fifth of assets in its wealth management business to the UBS takeover, according to a note by Citi analysts led by Nicholas Herman. That leaves between roughly 110 billion francs ($123 billion) to 162 billion francs up for grabs, as finews.com reported.

On Monday, Credit Suisse reported that it lost another 61.2 billion francs of client assets, of which 47.1 billion were in its wealth management unit. Its overall AuM fell to 1.253 trillion francs at the end of the first quarter from 1.294 trillion at the end of last year.

Then on Tuesday, UBS reported that its wealth management unit attracted $28 billion during the first quarter, of which $7 billion «came in the last ten days of March, after the announcement of our acquisition of Credit Suisse.»

It's safe to say that Swiss wealth managers' quarterly- and midyear reports will be scoured to see how much new money they attracted and how their AuM bases are developing. No doubt much will come through the efforts of their relationship managers, but it is also likely they will give a silent thanks to Credit Suisse.