Earning a decent return for their clients is what private banking is all about. But that’s exactly what private banks in Switzerland seem to struggle with – which could be a harbinger for their Asian colleagues.

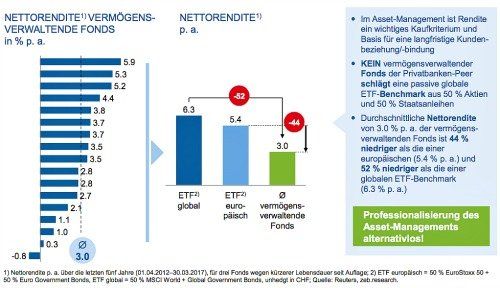

The main motivation to have a private bank manage your assets is a superior performance. But the portfolio managers of Swiss private banks on average perform comparatively badly. The average portfolio manager achieves a net performance of 3 percent per annum over a five-year period with strategies based on investment funds.

This is the finding of a bi-annual private banking study published by zeb consultants.

The performance of so-called wealth-management funds of 17 Swiss private banks is comparable to the one achieved by the wealth management industry.

Strong ETF Performance

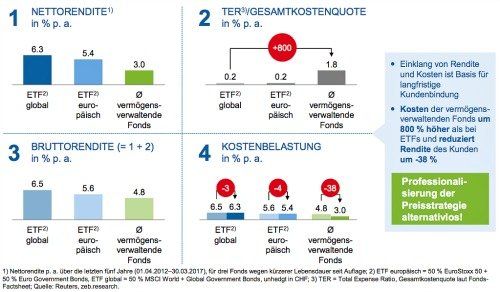

In the context of a shift towards digital banking, it is noteworthy that private banking performs significantly worse than passive instruments such as exchange traded funds (ETFs). If you invested your money in ETFs for European shares and governments bonds over a five-year period, you would have achieved a net yield of 5.4 percent. Applied globally, the strategy would have returned 6.3 percent, beating the performance of the private banks by more than 100 percent (see table below in German language).

The cheap money pumped into financial markets by central banks since 2009 have boosted stock exchange valuations and thus passive investment strategies. Beating benchmarks with active strategies is more difficult in rising markets. Some observers have said that there is a slight shift back toward active investments and away from the passive strategies.

Expensive Private Banking

Still, the gulf between returns for (cheap) passive instruments and (expensive) private banking prompts the question about why anybody would want to keep their assets with private banks. The zeb consultants say that the private banks charge about 1.8 percent for their services every year. Passive instruments by contrast cost 0.2 percent (see table below).

The cost of buying private-banking services in other words will reduce your return by 38 percent. Keeping level with ETF providers requires a reaction by the private banking industry. Only by cutting costs – through lower wages – and a better return will the industry be able to turn the tide, but also suffer a narrowing of their margin.

The margin of private banks has reached a level of 20 basis points (in 2016) according to zeb, a reading that the consultants deemed critical.

White-Money-Strategy

The pressure on private banks is also increasing due to tightening regulation, for instance MiFid II, which will pave the way for more transparency of wealth management costs in the European Union.

Private banking is faced with much stiffer international competition since the Swiss government decided to clean the banking industry’s reputation and to introduce the automatic exchange of information.

The Swiss financial market will likely see more consolidation in the coming years. The country currently has 130 private banks, down from 180 in 2010. The zeb consultants say the number will fall to 100 by 2021.