Hit by a management exodus and the 1MDB scandal, Falcon Private Bank is seeking a reboot to reflect the Swiss bank's digital transformation. How groundbreaking is the new identity?

Falcon Private Bank last year lost its bank license in Singapore, was pilloried as a laundering vehicle, and lost billions in client money as losses mounted. More recently, it lost CEO Walter Berchtold, chairman Christian Wenger and products and services chief Arthur Vayloyan.

All the more reason for the Swiss private bank, which is controlled by oil-rich Abu Dhabi, to distance itself from its past. New CEO Martin Keller on Monday introduced the bank's new strategic positioning.

Suddenly Digital

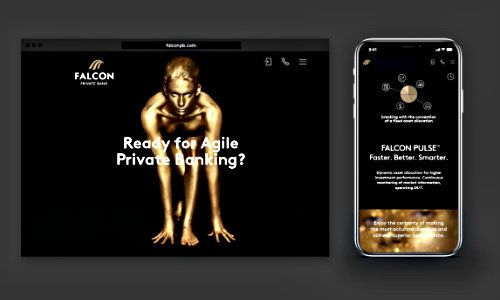

As previously reported, digitization is at the heart of Falcon's new strategy. A new brand campaign seeks to cement Falcon's identity as a digital firm.

To the fanfare of marketing jargon, Falcon explains its strategic positioning as «a unique combination of personal excellence and digital intelligence.» CEO Keller is convinced that the strategy will deliver value, better performance, and a higher degree of convenience for clients.

«Our digital competence will be a true strategic differentiator in the market,» Keller said.

Digital, But Not Yet Mobile

The core of the bank's strategy is digital platform Falcon Pulse, which aims to improve all the points of contact with wealthy clients. The jewel of Falcon Pulse is an algorithmic trading system which evaluates wealth allocation daily, delivering ideas for new investments.

The tool isn't yet available through mobile channels, but an e-banking and a mobile banking app will be rolled out shortly, the bank said. Keller said the bank is building its new strategy on the bank's DNA as an agile and performance-based boutique.

Clean Sweet of Past

Falcon is putting all its muscle into breaking with its past. The bank's involvement in the 1MDB scandal, its clumsy effort to move former long-standing boss Eduardo Lehmann out, a prison sentence for its former Singapore boss Jens Sturzenegger, and a fine from Swiss regulator Finma and other sanctions have damaged Falcon's reputation and its business.

The new start under former Credit Suisse private banking head Walter Berchtold as well as a renewal of Falcon's board ordered by Finma turned out to be a damp squib. Contrary to CEO Keller's assertions, the bank isn't yet on the solid ground that the new strategy suggests.

Not Rocket Science

Thanks to a partnership with digital asset manager Move, the introduction of cryptocurrency asset management and the launch of a digital platform with a modern identity, Falcon wants to position itself as a digital bank with «touch and feel». The idea is to beat the competition and attract a younger generation of clients.

The improvements aren't quite as groundbreaking as Monday's announcement suggests: user-friendly digital channels are a key element of private banking today. And a «smart» rebalancing of client portfolios isn't rocket science – most robo-adviser startups offer these services.

The bank has undergone a cultural shift towards a holistic advisory approach and anchored its new strategy with employees, maintains Branders, the agency which translated the bank's new vision into design and identity.