Credit Suisse's Historic Legerdemain Over UBS

Gut envisaged buying Volksbank for its retail business, leaving Credit Suisse to focus on foreign business and big, wealthy clients. In the early 1990s, negotiations between some of Switzerland's largest Swiss banks and Volksbank heated up. In fact, Volksbank Chairman Walter Rueegg ended up negotiating deals shortly after Christmas in 1992 with both Credit Suisse and UBS – without either knowing of the other's presence.

Dual-Track Talks

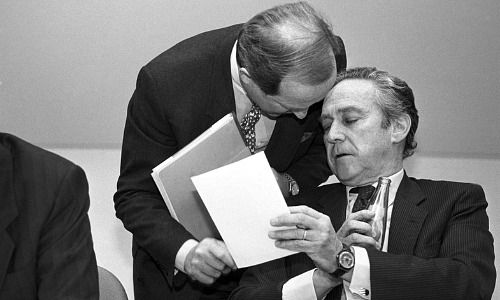

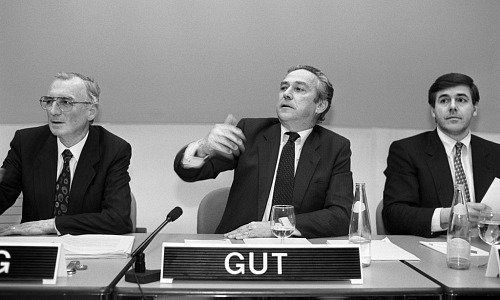

(Walter Rueegg, Rainer E. Gut, Josef Ackermann, Picture: Keystone)

On the last day of 1992, Credit Suisse splashed out with a formal offer for Volksbank – valid for just two days. On January 2, Gut and then-freshly-mined CEO Josef Ackermann headed for Bern to present to a Volksbank board committee.

The meeting didn't go well, and Volksbank's chairman phoned Gut later in the evening to break the news that the bank was opting for UBS' offer. In fact, Studer had presented UBS' offer to Volksbank on the same day, which the board unanimously accepted.

Gut refused to relinquish this «once in a century chance»: on January 3, he clinched approval from his board to begin lobbying Volksbank' directors individually in order to marshal support for Credit Suisse's offer.

Goliath «Superbank»

What happened next is emblematic of the rivalry between Switzerland's two major banks today: one day later, UBS asked for trading in its shares to be suspended, being «favorable» news. Ironically, this just gave Gut more time for his machinations.

He also launched a media campaign arguing that UBS and Volksbank would «considerably pervert the balance of power» among Switzerland's large banks. Credit Suisse, which traces its roots back to the golden age of Switzerland's infrastructure build, raised the specter of a «superbank», which would dominate and skew the Swiss banking market.