The global funds business is seeing hectic takeover activity, putting pressure on the Swiss market leaders to follow.

«Look right. Then, look left», Cyrus Taraporevala tell his audience. «In ten years most of you won't be sitting here».

Nervous laughter ensues in the room, which is replete with fund specialists.

That was in 2019 - well before the pandemic. Even then, industry consolidation was a sore topic, and the head of State Street Global Advisors didn't need to do much to raise everyone's hackles at the «Future of Asset Management» conference.

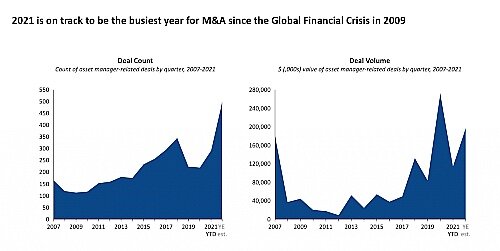

M&A activity is rife, with U.S. consulting firm Casey Quirk recently calculating that the the past nine months have seen the highest rates of mergers and takeovers in the global asset management industry since 2007 (see graphic below).

A Small Deal Frenzy

An analysis by data provider Refinitiv backs that up, saying that smaller deals below $1 billion are at the highest level seen since then as well. It also appears that the transactions are not being made under any pressure, as the main industry exponents continue to perform in buoyant markets.

Swiss Banks Are Under Pressure

The elephant in the room that no-one is talks about is what the major Swiss banks will do. Although they dominate the domestic market, they don't seem to have enough global critical mass. UBS Asset Management reported $1.2 trillion in invested assets last June and Credit Suisse Asset Management (CSAM) had about 471 billion Swiss francs ($512 billion) in assets under management.

That is likely why rumors about both businesses have intensified, particularly CSAM, where it has gone very quiet since the Greensill fiasco.

New Leadership

António Horta Osório, Credit Suisse's chairman, wants to unveil a new strategy for the beleaguered bank by the end of the year, likely around the 4th of November. He has already indicated that he is open to divestments where he doesn't see a competitive advantage. That could mean asset management.

The «Financial Times», citing anonymous sources, said the bank might release the internal report it is compiling with Deloitte related to Greensill along with its third quarter figures. That should bring increased clarity to the risks the business has been running, maybe even prompting some to take further action against the bank.

The Short End of the Stick

UBS has been pretty passive through all this. Although it was one of the bidders for Dutch fund provider NN Investment Partners (NN IP), it was Goldman Sachs that eventually bought it from under their nose. If anything, the whole thing serves to show how easily bidders can become takeover candidates.

As an example, speculation in Switzerland persists about a possible three way merger between UBSAM, CSAM and Deutsche Bank unit DWS, the latter also unsuccessfully bidding for NN IP. In 2019, talks were even allegedly held between UBS and Deutsche bank about merging the two businesses, although they were apparently quickly broken off.

Written in Stone

Nothing in the industry is written in stone and events could make both start talking again. Amundi's 2016 takeover of Italy's Pioneer shows that cross-border mergers in the European funds business are not only possible, but can even be beneficial.

Taraporevala wasn't entirely right in 2019 when he said the industry was "locked in a Darwinian struggle that will reshape the competitive landscape".

But it is also clear that the good times won't last forever. And that should be incentive enough to seize the opportunities in the market.