Robert Almeida: «The Need to Reach Deeper Into the Tool Box»

Many of today’s investors have become conditioned to rising markets and a system that allowed for the privatization of profits and wealth and the socialization of capital losses when markets exhibited sustained stress. Given that many in today’s marketplace are dismissing these warning signals, perhaps we need to take a different perspective, Robert Almeida writes in an article on finews.first.

Enthusiasm around artificial intelligence, falling inflation readings and better-than-feared economic data have all been contributing forces to the strength in global equity markets this year. At the same time, earnings growth expectations have been low to slightly negative. With the prices being paid for stocks rising, unaccompanied by higher profit expectations, the P/E multiple on stocks has expanded. Investors are paying a lot more for the same profit stream.

We can also observe this through the lens of equity risk premia. The expected earnings yield on stocks over the yield offered by government bonds has historically averaged 3 percent to 5 percent. The combination of interest rates at more normal, free-market levels following the rate-hiking cycle begun in 2022 and this year’s equity market rally has pushed risk premia to extremes not seen since the internet bubble.

«What often gets left out is the enormous capital cycle that the internet created»

Famed British statistician George Box felt all models are inherently flawed by nature of being rooted in the past but understanding those flaws has value. That knowledge allows you to vary the weightings or emphasis placed on different inputs given the assumed or perceived circumstances and differences compared with the past.

Earlier, I referred to the internet bubble. Since it popped over two decades ago, many current investors weren’t managing portfolios then, yet most are at least familiar with the circumstances surrounding that historic episode.

What is often most remembered were the skyrocketing valuations of businesses with a .com or .net attached to it. But what often gets left out is the enormous capital cycle that the internet created. Computers were being put onto every desktop and connected to each other via the internet. This catalyzed a corporate investment cycle that drove exploding economic and sales growth. Nonetheless, valuations were so outrageous that despite the enormous growth, stocks were very expensive even on a price-to-sales ratio basis.

«That regime died in 2022»

But the post-2008 business cycle was entirely different. There was no capital expenditure cycle. Deflation fears, falling money velocity and weak end-demand diverted borrowed corporate capital away from fixed investment (e.g., equipment) towards stock repurchases, higher dividends and acquisitions. That combination resulted in the weakest business cycle in over a century and in historically anemic sales growth.

Yet stocks did fantastically well because companies were able to drive profitability by suppressing costs amid falling interest expenses, the offshoring of labor and falling fixed investment. However, that regime died in 2022, and profit subsidies from low rates, offshoring and underinvestment have not only ended but reversed.

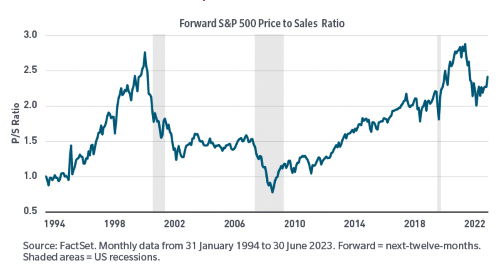

Given how short-term and linear many equity investors are, perhaps forward twelve-month price-to-earnings ratios and earnings yields understate the risks. Leveraging the George Box playbook, the following exhibit shows the price-to-sales ratio for the S&P 500 since the mid-1990s.

(To enlarge, click on the graphic)

As noted earlier, despite the high-growth era of the 1990s, equities were expensive even on this growth-dependent metric. Not surprisingly, given how weak the economy and sales growth were throughout the post-2008 business cycle, we saw the ratio expand and reach peaks last seen at the height of the internet bubble. Price-to-sales fell some in 2021 due to the post-lockdown growth that resulted from fiscal and monetary stimulus, which has since faded and why the ratio is re-accelerating, as stock prices have risen in 2023.

«The cheap labor regime has ended»

Equities are expensive on traditional valuation measures. The bigger picture, however, is more nuanced. The regime of low capital costs has ended as accumulated debt levels will need to be financed at higher cost, pulling down free cash flow. The cheap labor regime has ended. And the regime of over-stretched supply chains and underinvestment in cleaner (energy) ways of running businesses has ended.

Back to Mr. Box’s axiom about models being wrong but some useful, I think of valuation similarly. Every business cycle and market environment is different, and these idiosyncrasies influence the usefulness of various valuation metrics and is why a broad mosaic of valuation inputs, and understanding the flaws in each, can be instructive.

«The tools necessary to navigate the current regime are different from the last»

We have begun a new regime. A regime where capital and labor are scarcer than at any point since 2009. A regime where not all companies will be able to outearn their new or normalized input costs. A regime of higher loan and bond defaults, capital restructurings and bankruptcies. The tools necessary to successfully navigate the current regime are quite different from the last.

As Mr. Box might have suggested, recognize that all valuation and fundamental models are broken, but some are still useful. Investors will need to do a lot more homework and may find it advantageous to use a mosaic of not only valuation but also fundamental tools, to help guide the way through this cycle.

Robert M. Almeida Jr. is an investment officer and global investment strategist for MFS Investment Management MFS Investment Management (MFS). He also serves as a member of the portfolio management teams for multiasset income and alternative strategies. He joined MFS in 1999. He is a graduate of the University of Massachusetts and earned his Master of Science degree in finance from Sawyer Business School.

Previous contributions: Rudi Bogni, Peter Kurer, Rolf Banz, Dieter Ruloff, Werner Vogt, Walter Wittmann, Alfred Mettler, Robert Holzach, Craig Murray, David Zollinger, Arthur Bolliger, Beat Kappeler, Chris Rowe, Stefan Gerlach, Marc Lussy, Nuno Fernandes, Richard Egger, Maurice Pedergnana, Marco Bargel, Steve Hanke, Urs Schoettli, Ursula Finsterwald, Stefan Kreuzkamp, Oliver Bussmann, Michael Benz, Albert Steck, Martin Dahinden, Thomas Fedier, Alfred Mettler, Brigitte Strebel, Mirjam Staub-Bisang, Nicolas Roth, Thorsten Polleit, Kim Iskyan, Stephen Dover, Denise Kenyon-Rouvinez, Christian Dreyer, Kinan Khadam-Al-Jame, Robert Hemmi, Anton Affentranger, Yves Mirabaud, Katharina Bart, Frédéric Papp, Hans-Martin Kraus, Gerard Guerdat, Mario Bassi, Stephen Thariyan, Dan Steinbock, Rino Borini, Bert Flossbach, Michael Hasenstab, Guido Schilling, Werner E. Rutsch, Dorte Bech Vizard, Adriano B. Lucatelli, Katharina Bart, Maya Bhandari, Jean Tirole, Hans Jakob Roth, Marco Martinelli, Thomas Sutter, Tom King, Werner Peyer, Thomas Kupfer, Peter Kurer, Arturo Bris, Frederic Papp, James Syme, Dennis Larsen, Bernd Kramer, Armin Jans, Nicolas Roth, Hans Ulrich Jost, Patrick Hunger, Fabrizio Quirighetti, Claire Shaw, Peter Fanconi, Alex Wolf, Dan Steinbock, Patrick Scheurle, Sandro Occhilupo, Will Ballard, Nicholas Yeo, Claude-Alain Margelisch, Jean-François Hirschel, Jens Pongratz, Samuel Gerber, Philipp Weckherlin, Anne Richards, Antoni Trenchev, Benoit Barbereau, Pascal R. Bersier, Shaul Lifshitz, Klaus Breiner, Ana Botín, Martin Gilbert, Jesper Koll, Ingo Rauser, Carlo Capaul, Markus Winkler, Thomas Steinemann, Christina Boeck, Guillaume Compeyron, Miro Zivkovic, Alexander F. Wagner, Eric Heymann, Christoph Sax, Felix Brem, Jochen Moebert, Jacques-Aurélien Marcireau, Ursula Finsterwald, Michel Longhini, Stefan Blum, Zsolt Kohalmi, Karin M. Klossek, Nicolas Ramelet, Søren Bjønness, Gilles Prince, Salman Ahmed, Peter van der Welle, Ken Orchard, Christian Gast, Jeffrey Bohn, Juergen Braunstein, Jeff Voegeli, Fiona Frick, Stefan Schneider, Matthias Hunn, Andreas Vetsch, Fabiana Fedeli, Kim Fournais, Carole Millet, Swetha Ramachandran, Thomas Stucki, Neil Shearing, Tom Naratil, Oliver Berger, Robert Sharps, Tobias Mueller, Florian Wicki, Jean Keller, Niels Lan Doky, Karin M. Klossek, Johnny El Hachem, Judith Basad, Katharina Bart, Thorsten Polleit, Peter Schmid, Karam Hinduja, Zsolt Kohalmi, Raphaël Surber, Santosh Brivio, Mark Urquhart, Olivier Kessler, Bruno Capone, Peter Hody, Michael Bornhaeusser, Agnieszka Walorska, Thomas Mueller, Ebrahim Attarzadeh, Marcel Hostettler, Hui Zhang, Michael Bornhaeusser, Reto Jauch, Angela Agostini, Guy de Blonay, Tatjana Greil Castro, Jean-Baptiste Berthon, Marc Saint John Webb, Dietrich Goenemeyer, Mobeen Tahir, Didier Saint-Georges, Serge Tabachnik, Vega Ibanez, David Folkerts-Landau, Andreas Ita, Michael Welti, Mihkel Vitsur, Fabrizio Pagani, Roman Balzan, Todd Saligman, Christian Kaelin, Stuart Dunbar, Carina Schaurte, Birte Orth-Freese, Gun Woo, Lamara von Albertini, Ramon Vogt, Andrea Hoffmann, Niccolò Garzelli, Darren Williams, Benjamin Böhner, Mike Judith, Jared Cook, Henk Grootveld, Roman Gaus, Nicolas Faller, Anna Stünzi, Thomas Höhne-Sparborth, Fabrizio Pagani, Guy de Blonay, Jan Boudewijns, Sean Hagerty, Alina Donets, Sébastien Galy, Roman von Ah, Fernando Fernández, Georg von Wyss, Stefan Bannwart, Andreas Britt, Frédéric Leroux, Nick Platjouw, Rolando Grandi, Philipp Kaupke, Gérard Piasko, Brad Slingerlend, Dieter Wermuth, Grégoire Bordier, Thomas Signer, Brigitte Kaps, Gianluca Gerosa, Christine Houston, Manuel Romera Robles, Fabian Käslin, Claudia Kraaz, Marco Huwiler, Lukas Zihlmann, Nadège Lesueur-Pène, Sherif Mamdouh, Harald Preissler, Taimur Hyat, Philipp Cottier, Andreas Herrmann, Camille Vial, Marcus Hüttinger, Ralph Ebert, Serge Beck, Alannah Beer, Stéphane Monier, Ashley Simmons, Lars Jaeger, Shanna Strauss-Frank, Bertrand Binggeli, Marionna Wegenstein, George Muzinich, Jian Shi Cortesi, Razan Nasser, Nicolas Forest, Joerg Ruetschi, Reto Jauch, Bernardo Brunschwiler, Charles-Henry Monchau, Philip Adler, Brigitte Kaps, Ha Duong, Teodoro Cocca, Beat Wittmann, Jan Brzezek, Florin Baeriswyl, Nicolas Mousset, Beat Weiss, Pascal Mischler, Andrew Isbester, Konrad Hummler, Jan Beckers, Martin Velten, Katharine Neiss, Claude Baumann, Daniel Roarty, and Kubilay Yalcin.