UBS: «Modest» Goals in the US Financial Rush

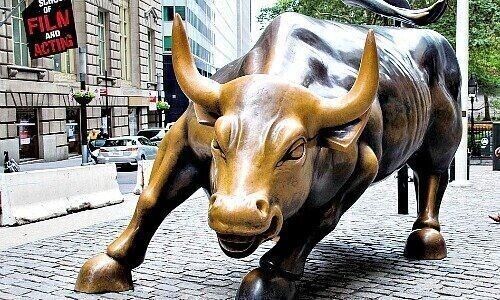

Wall Street is the world’s most important financial center, and investment banking is its prime discipline. UBS is also taking part in the concert of the big players, but it only wants to play the second fiddle.

The American market is one of the most important for the Swiss banking giant UBS. But when it comes to investment banking, it only plays second fiddle behind the Wall Street giants in the USA. And this is likely to remain the case for the foreseeable future, as the «Wall Street Journal» reported on Tuesday.

In the course of the acquisition of Credit Suisse, UBS had announced its ambitions to break new ground in this business area. It had even taken steps to play a more prominent role in investment banking. With that in mind, it recruited a number of high-level staff, increased research and intensified discussions with potential customers.

Number Six

However, CEO Sergio Ermotti wants UBS to remain primarily an asset manager.

While in US investment banking, UBS sets itself realistic goals, they are rather modest in comparison to wealth management. It wants to be «only» number six in the USA as Rob Karofsky, head of the UBS Investment Bank, explained to the US business newspaper. Or to put it more positively: it wants to position itself on Wall Street as the best alternative directly behind the market leaders – and play an important role worldwide.

Minefield for Europe’s Banks

The fact that UBS has been piling on deeper in US investment banking, however, does not come as a surprise. Teodoro Cocca, Professor of Asset und Wealth Management at Johannes Kepler University of Linz wrote in an earlier post for finews.first, the US market is repeatedly proving to be a minefield for European banks in which market shares have to be conquered with an increased appetite for risk.

US financial giants like J.P. Morgan, Goldman Sachs, and Morgan Stanley have a significant lead, and European banks have so far been hardly able to stand up to Wall Street’s top dogs. Previous attempts by HSBC, UK’s largest bank, or by Deutsche Bank to break the phalanx of these US financial giants failed. U.K.’s Barclays Bank has currently positioned itself as the main European institution in US investment banking.

Lessons From the Past

UBS, too, has tried to rank in the top five in US investment banking in the past. In 2008, it climbed to number 7 in North and South America. But, the financial and economic crisis led to losses in the billions and eventually to a bailout by the state. Ermotti, who was appointed CEO in 2011, thus reduced the size of the investment bank and, in return, put more emphasis on asset management.

But even these rather modest goals are likely to be difficult for the Swiss banking giant to achieve. According to its statements, UBS’s corporate strategy is to allocate only 25 percent of the bank’s assets to investment banking. This might restrict its ability to provide loans for transactions.

According to Dealogic’s revenue-based ranking, which no longer includes figures for an independent UBS in the USA, UBS ranked 25th in investment banking in America in 2022. In Europe and Asia, by contrast, it has traditionally done better than in the USA.