The US elections are set to take place tomorrow. The outcome is believed to be too close to call and banks are advising investors to stay diversified with some safe haven exposure to gold.

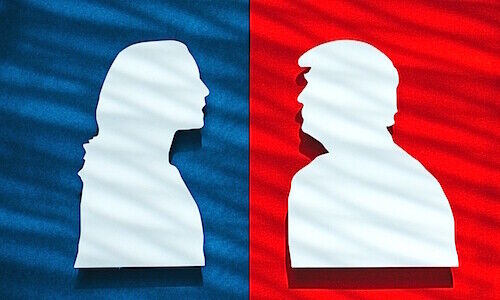

Tomorrow, the United States will kick off its presidential election in a race between Donald Trump and Kamala Harris. Markets have taken a pause with the S&P 500 shedding some gains after peaking in mid-October.

How will markets perform in the upcoming days? How will it react to a victory by either candidate?

Investing Under Trump or Harris

According to video by UBS’ chief investment office, the bank sees a 50/50 chance for either Trump or Harris to win, recommending a diversified portfolio focusing on broader drivers like Fed rate cuts and AI trends.

It attributes a 35 percent probability for a Red sweep, which could trigger initial market rallies due to favorable tax and deregulation with financials, healthcare and materials to benefit. Potential tariff changes might introduce sector volatility with tech and consumer facing challenges.

Conversely, UBS believes there is a 45 percent chance of a Harris win with a divided Congress. This is expected to have a limited impact on US stocks with slight regulatory pressures on financials and modestly negative effects on healthcare.

Gold Bull

One of the most common overweight calls is on gold as a means to counter uncertainty and geopolitical risks. According to a Julius Baer note, the recent gold rally is attributable to bullish sentiment and the upcoming election. There is also allegedly high conviction amongst large institutional investors due to the belief that US fiscal deficits are set to stay large alongside a bullish wildcard for public unrest, especially if Harris wins.

«The headline of record high global gold demand should […] support the bullish narrative, not least with the US presidential elections,» said Carsten Menke, head of next generation research at Julius Baer. «That said, the extreme euphoria in the markets makes prices susceptible to a short-term but temporary setback which will likely be treated as a longer-term buying opportunity.»

Short-Lived Volatility

Despite concerns about market turbulence, Standard Chartered believes it will not last very long.

«[H]istory suggests this volatility tends to be short-lived. Therefore, we believe longer-term Foundation allocations are better driven by a focus on the underlying fundamental backdrop, which remains positive,» the bank said in a note.

«US macro data thus far remain consistent with a soft-landing, supported by further Fed rate cuts. This is why we remain Overweight US equities within a broader core allocation of global stocks.»