Qatar has begun pruning its stake in Credit Suisse. finews.asia shows how the Swiss bank may uncouple from a crisis-era partnership with the emirate as soon as next year.

For former Credit Suisse boss, clinching a major, crisis-time injection of capital from Qatar was a «good job.» The billion-dollar shot in the arm helped the Swiss bank avoid the painful state rescue that UBS was forced to take.

Qatar and Credit Suisse have been tight ever since – and indeed why shouldn't they be: the emirate earns hundreds of millions on a high coupon from two different convertible instruments issued in 2008.

Relationship Ruptures

This year, ruptures in that alliance have emerged, though Qatar is famously secretive about its investments. As finews.com reported, Qatar offloaded stock, five months after its 39-year-old representative Bin Hamad J.J. Al Thani (pictured below) left Credit Suisse's board with little explanation and no replacement.

The exit of Al Thani, who was reportedly better known for interrupting board meetings for regular cigarette breaks than for asserting any forceful opinion of its strategy or positioning, fed rumors of a fissure.

Juicy Coupon

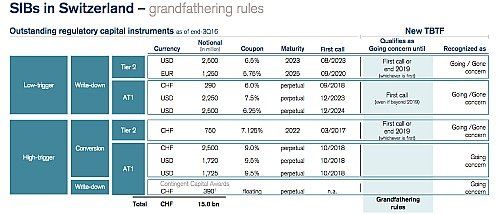

Qatar hasn't touched its most lucrative investment in Credit Suisse:two convertible instruments with a nominal value of 2.5 billion Swiss francs and $1.72 billion, respectively. Switzerland's central bank actually gave rise to the so-called CoCos, after in 2011 roundly criticizing Credit Suisse under Dougan for sailing too close to the wind on capital, an issue which has dogged the bank until early this year.

Thus, in these days of hunting for yield amid ultra-low to negative interest rates, Credit Suisse pays Qatar a juicy 9 percent and 9.5 percent coupon on the instruments, respectively. In other words, an automatic 380 million francs for the emirate every year – essentially forever, because the instruments are «perpetual» in design.

First Call 2018

This eternity could come to an end after all. Next October, Credit Suisse has the right to «call» the instruments for the first time (see below). This means the bank can buy the securities back from Qatar, or replace them with other instruments. finews.com has learned that Credit Suisse under Chief Executive Tidjane Thiam is exploring whether and how to do exactly that.

A September 2016 presentation by Thiam and finance chief David Mathers, who was instrumental in clinching the 2008 deal, clinches this view. Mathers explained to creditors that the bank would be able to replace its capital instruments against new, so-called loss-absorbing ones, also referred to as AT1, from 2017 on.

Good Solution – For Everyone

Andreas Venditti, Bank Vontobel's banking analyst and a longtime observer of Credit Suisse, believes buying back or replacing Qatar's securities is a valid option for the bank.

«I wouldn't be surprised if Credit Suisse replaced Qatar's convertible instruments as soon as they are callable in 2018,» he told finews.com.

How exactly? Credit Suisse replenished the hardest form of core capital with its recent capital increase. That's why it is possible that the bank only partially has to replace the Qatar convertibles with AT1, or loss-absorbing, instruments, Venditti says.

Why is this key? Because it would benefit all sides – Credit Suisse would no longer have to pay out hundreds of millions every year, and could instead put it towards pre-tax profits. Credit Suisse insiders say the bank is acutely aware of this and at pains to find an «economically sensible» solution.

Like Warren Buffett?

The unknown variable in the equation – probably even to Credit Suisse – is what Qatar wants. The Qatari Investment Authority, or QIA, has the last word. It is unclear how a blockade by several of its neighbors led by Saudi Arabia is influencing thinking in Qatar, which also holds stakes worth billions in Deutsche Bank and Barclays.

Obviously, terms of any deal would be carefully hashed out between the two. Swiss Re provides a potential template: investing legend Warren Buffett helped shore up the reinsurer in 2009 with a 3 billion franc convertible, agreed an early redemption the following year.

Between the premium on the emergency cash and the high interest payments, Swiss Re ultimately paid Buffett roughly 4 billion francs. The coming weeks and months will show whether Credit Suisse can negotiate as favorable a deal with its erstwile savior.