Two of Julius Baer's top executives are competing against each other. Both think they have a good shot at winning the internal face-off.

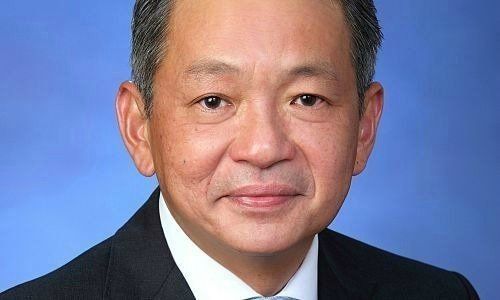

Jimmy Lee (pictured below), Julius Baer's top man in Asia, is accustomed to the spotlight. His region is the showcase of Julius Baer's growth, and the Zurich-based private bank has expanded prolifically under both Lee and his predecessor, Thomas Meier, as finews.com reported in December.

If Lee is the bank's biggest star at the moment, Yves Robert-Charrue wants to object. The restless banker, responsible for Europe since last year, has challenged Lee to a friendly competition, he told newswire «Reuters» (in German). «My colleague in Asian and I have bet which region will be stronger in the long run», Robert-Charrue said.

The remarks from the Swiss banker, who has a shot at the top job if he prevails in the Europe role, are a remarkable show of confidence versus Julius Baer's Asian growth engine. «Net new money growth in Europe is at least as good as in Asia,» Robert-Charrue told the agency. The two regions account for roughly one-quarter, respectively, of Julius Baer's total asset bulk, but Europe was long neglected by the bank is favor of ramping up aggressively in Asia.

European Dealmaking?

While Julius Baer says it is focused on growing organically, Robert-Charrue apparently has the nod from CEO Bernhard Hodler to cast around for potential acquisitions. The bank is constantly looking: «If we see something interesting, then we'll do it», Robert-Charrue said.

In recent months, the European arm has made headlines by poaching scores of bankers from rivals, particularly in Germany and Britain, where Julius Baer is the latest Swiss bank to push in. «In Europe, it's about winning market share off rivals,» Robert-Charrue said. «We see potential for more hiring in big, strategic markets».