A veteran portfolio manager with a Swiss bank has criticized recruiting in Asia, saying private bankers don't measure up to their European counterparts, but demand more.

As Asia's private banking industry grows apace, wealth managers face an expensive and time-consuming war for private banking talent as demand far outstrips supply. Now, a veteran banker at a Swiss company has drawn unflattering comparisons between private bankers in the relatively young Asian wealth management industry to their European counterparts, where the sector is centuries old.

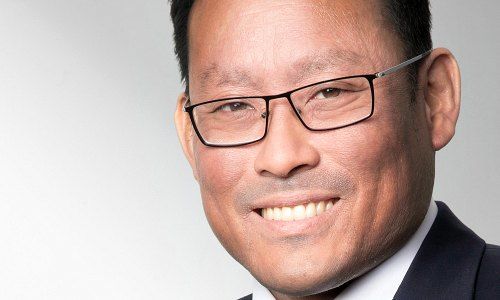

Private bankers from big firms aren't always aware that they will have more freedom at smaller ones, according to Daryl Liew, Banque Reyl's head of portfolio management in Singapore.

«I told them: 'We are a small bank; I am able to have a chat with you and offer some guidance, but I am not going to spoon-feed you with ideas,'» Liew told website «pwm.net».

His comments offer an unvarnished look at the contrast between boutiques such as Reyl to industry giants including Citigroup and UBS, which have an elaborate process of daily market briefings and product rosters which fan out into the various segments of its private banks in the hopes of animating clients to trade.

More Money, Less Chops

Liew didn't mince his words on the professional quality of private bankers in Asia either, saying they fail to measure up to their counterparts in Europe – but want higher pay. «There are good relationship managers in Singapore, but their number of years of experience falls far short of what you see in Europe,» he said. Nevertheless, «they expect more money here».

To be sure, private bankers in Europe are paid well in contrast to retail bankers, for example, even if they do not enjoy the huge bonuses typical for investment banking rainmakers. Meanwhile, pay packages for wealth managers in Asia have skyrocketed as the war for talent intensifies.

The comments from Liew come as minnows like Reyl and Vontobel attempt to benefit from a shift in Asia from a trading-enamored clientele towards increasing demand for advice, long-term planning help, and independence. This is a departure for most private banks, which have propped up their profits in Asia for years with transaction fees from trading.