Switzerland is still the world’s leading offshore banking center. But the gap to its rivals has shrunk sharply from 2010 to 2017. A new study shows that Swiss banking has a pressing problem.

«We are the best»: Herbert J. Scheidt, chairman of the Swiss Banking Federation (SBVg), told members at a recent banking conference. Maintaining Swiss banking’s lead over its competitors – in the west as well as the east – is the main aim of the banking sector lobby led by Scheidt.

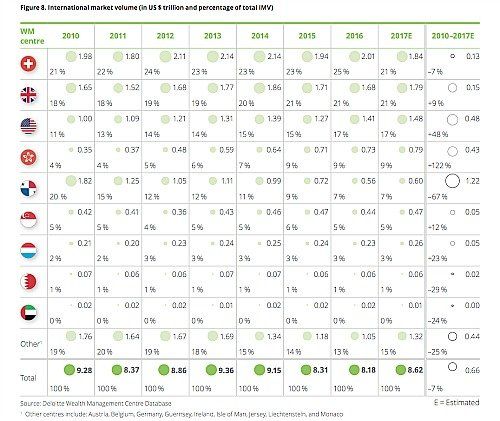

A new study by Deloitte shows that this lead in asset management is melting away fast. With $1.84 trillion in managed assets, Switzerland is still the world’s leading offshore banking center. But the gap to its rivals has shrunk sharply from 2010 to 2017, with its Anglo-Saxon competitors the main beneficiaries, the study showed (see graphics below).

U.S. the Clear Winner

Great Britain follows closely on Switzerland’s heels, with a gap of «only» $50 billion, Deloitte said. The U.S. has attracted the most new money in the past seven years, accumulating $480 billion, while Hong Kong has posted the biggest percentage gain in new assets, with a rise of 122 percent.

The Swiss offshore banking sector lost about 7 percent in volume during the same time period. At first glance this looks acceptable, since Swiss banks have become more competitive. Deloitte concluded that Swiss banks have become world champions in the competitive race.

Swiss banking is also more profitable than most of its foreign competition, thanks to a mix of cost-saving measures and relatively high fees. Furthermore, the quality of banking services, measured against the know-how of their advisers, client protection, and the political and economic stability, remains top.

Shrinkage Despite Increased Wealth

Still, the lemon has been squeezed dry. In the medium term, Swiss asset managers will again need to attract more foreign monies, otherwise the record profit levels will evaporate.

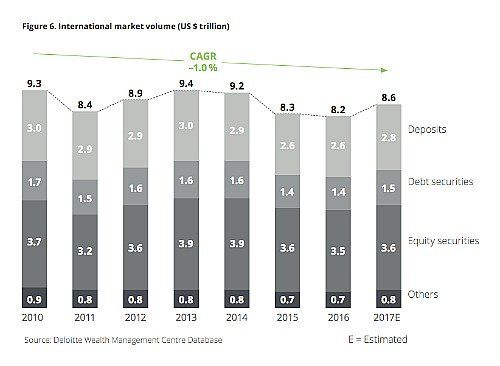

Achieving growth is easier said than done. The market volume of the world’s leading financial centers has shrunk by 1 percent since 2010 (see graphic below).

This appears counterintuitive at first glance, as the volume of global wealth has risen by a third to $280 trillion and the number of billionaires has increased substantially.

With the record low interest rates, the wealthy are putting their money increasingly into real estate and other asset instruments. Investments in other words which are difficult to place in foreign banks. A further negative for the offshore centers are the capital barriers and tax amnesties introduced by several countries around the world.

Swiss New Money Problem

If the stock market boom cycle is indeed nearing its end, it will only add to the growth problems facing Swiss asset managers. While most of its foreign rivals were able to attract net new money in 2017, the Swiss balance was negative, according to Deloitte. If the calculations of the consultants are right, the Swiss supremacy claimed by SBVg Chairman Scheidt is in acute danger of folding.