A former trader at the bank sent shockwaves through the financial services community in July this year when she accused a managing director at UBS of drugging her and then raping her at his South London home.

Email to All Staff

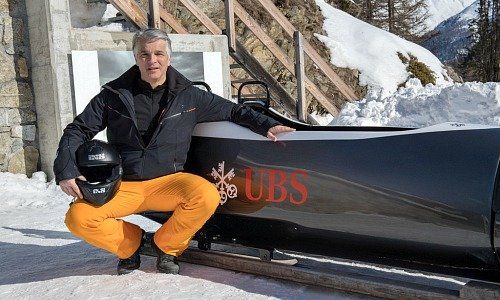

The bank did not help matters when it sent an email to all staff saying a review of how it handled the case, conducted under the aegis of law firm Freshfields (pictured above), found there were «no fundamental errors in its process». The U.K. financial market authority, the FCA, reached out directly to the woman making the accusations. The fact that she had reached out to the then-head of the investment bank at UBS, Andrea Orcel (pictured below), raised the profile of the case and it dominated headlines for most of August and September.

Andrea Orcel, the man dubbed the «Godfather of investment banking» by the «Financial Times», reigned from his responsibilities as the head of the investment bank at UBS to be CEO at Spain’s Banco Santander. Orcel is rumoured to have been one of the highest-earning employees at the bank and a likely successor to chief executive Sergio Ermotti.

Orcel's Shock Move

That the consummate dealmaker was leaving for what is largely a retail bank, must have been salt in the wounds as far as UBS was concerned. Even as senior leaders led one team call after another to provide some succour to employees in the wake of Orcel’s shock move, the «Financial Times» ran an article headlined «UBS investment bankers fear for future as their star departs».

The world’s largest wealth manager was overthrown as the «Best Global Private Bank» at the annual Global Private Banking Awards (pictured above) hosted by the «Financial Times», acknowledged by many as the «gold standard» of private banking awards. American behemoth Citigroup’s Private Bank snatched the crown from UBS.

Clients Voted Differently

Although Wall Street won the investment banking sweep-stakes a while ago, private banking is still viewed as the prerogative of a few blue-blooded Swiss banks, amongst whom UBS stands tall. Citi’s win belies that.

Perhaps UBS management took comfort from the fact that their most important stakeholders – clients – voted differently that the awards jury. Net new money at UBS was at $44 billion versus $22 billion at Citi despite favourable U.S. tailwinds.

- << Back

- Page 2 of 2