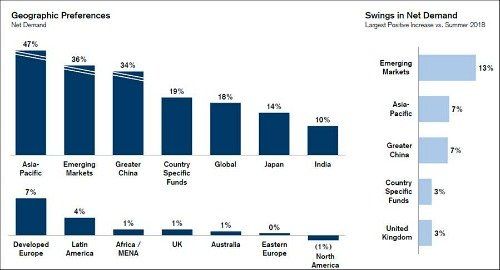

For the second year in a row, the Credit Suisse Hedge Fund Investor Survey indicates that Asia-Pacific and Emerging Markets are the most in-demand regions for investors.

Credit Suisse released its 2019 Hedge Fund Investor Survey, entitled «Trimming the Sails», which polled over 310 institutional investors globally representing $1.12 trillion in hedge fund investments. Participants were surveyed on a number of topics, including key industry trends and forecasts, as well as strategy preferences and allocation plans for 2019.

For the second year in a row, investors indicated that Asia-Pacific and Emerging Markets are the most in-demand regions, with Greater China the most preferred overall country. While interest waned over the course of 2018 (per the 2018 Mid-Year Hedge Fund Investor Survey), strong demand returned in 2019 with the three geographies seeing the largest positive net demand swings.

Key highlights from the 2019 Credit Suisse Hedge Fund Investor Survey:

1. Customized Offerings Dominate

Capital continues to flow to non-traditional products. 58 percent of allocations over the past 12-18 months were directed to alternative structures, principally Bespoke Managed Accounts and Co-Investments. A growing interest in customized mandates has led investors to optimize their existing hedge fund relationships, developing holistic partnerships with a concentrated group of managers. The result is a consolidation of hedge funds in allocator portfolios, where the average number of managers in a portfolio (31) is down 35 percent from 2009.

2. Investors Bucket Hedge Funds by Asset Class

An increasing number of allocators are integrating hedge funds into their overall portfolio. 42 percent of investors now categorize hedge fund allocations by an underlying asset class (eg. Equities, Fixed Income) instead of the static, ‹Alternatives› tag.

3. Hedge Fund AUM Recycled within, not Removed from the Industry

Redemptions from managers will largely be recycled and stay in the industry. 89 percent of investors who redeemed from hedge funds in 2018 expect to recycle that capital to other hedge funds, with an increasing amount accruing to managers already in an allocator’s portfolio.

4. Manager Selection Factors

Performance and downside protection remain paramount evaluation factors for established firms. For new launches, pedigree and performance were most valued, along with a new top factor, the state of the C-Suite team.