Despite the dominance of cash, card payments volume in Hong Kong is expected to surpass one billion in 2020, says GlobalData.

The convenience of electronic payments, robust payment infrastructure and the emergence of contactless payments are expected to drive the total number of card payments from 642 million in 2015 to 1 billion in 2020, according to GlobalData, a data and analytics company.

«Hong Kong’s high banked population, growing preference for contactless technology and, the growing e-commerce market will further support the use of payment cards over the next five years,» said Nikhil Reddy, banking and payments analyst at GlobalData, in a media statement on Monday.

Efforts in Remote Areas

Hong Kong has a highly penetrated payment card market, with each individual holding more than three cards in 2019. The steady progress in the adoption and use of payment cards, plus the high penetration, are supported by the government and banks’ efforts to provide banking services even in remote areas.

The expansion of banking infrastructure through the introduction of mobile banking branches, new physical bank branches and the establishment of virtual banks, were also factors.

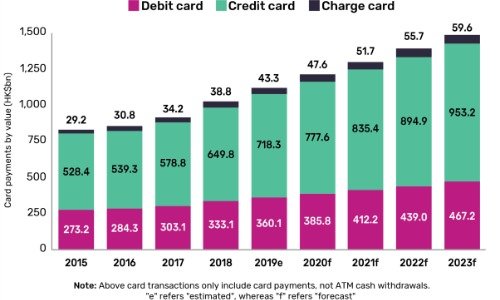

Source: GlobalData Banking and Payments Intelligence Centre

Pricing Benefits

Hong Kong’s payment card market is mainly driven by credit and charge cards, which accounted for 67.9 percent of total card payment value in 2019, according to GlobalData. The total card payment value in the country is forecast to increase from HK$43.3 billion in 2019 to HK$59.6 billion in 2023.

The pricing benefits such as referral programs, installment facilities, cashback and discounts associated with credit and charge cards are some of the key reasons for their preference. In addition, these cards are increasingly preferred for online shopping and for transactions overseas.