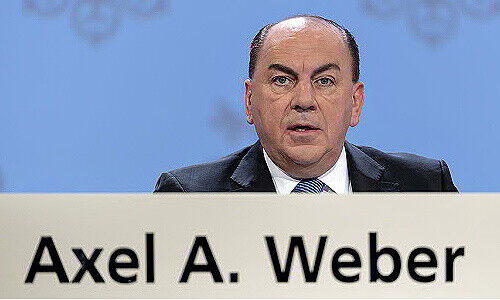

UBS Chairman Axel Weber is a hostage to a situation beyond his control. The overseer’s botched succession imperils the Swiss wealth manager's renewal – and Weber's legacy.

This isn’t how he envisioned his last 14 months at UBS: Axel Weber wanted to end on a high note, poaching one of Europe’s most talented banking innovators, Ralph Hamers (pictured below), to work his magic on the hidebound Swiss giant. Instead, Weber is thinking about Plan B as UBS decides if it can sweat out an up to 18-month Dutch criminal investigation into Hamers’ time at ING.

The prospect looks increasingly unlikely: UBS’ board is working on a timeline of roughly six months to resolve the «hugely unappealing» situation, a person familiar with the matter said. A spokesman for UBS declined to comment.

What’s at stake? The bank desperately needs Hamers’ know-how to revitalize, but not with those plans effectively captive to the Dutch legal process, nor at the cost to its reputation.

CEO «Can-Opener»

Much of the attention thus far has been on Hamers: the 54-year-old Dutch banker is «the can-opener» for what happens next, as one person puts it. UBS’ board has thus far satisfied itself with waiting until Hamers concludes he is trammeled by the probe, making his day job impossible.

For Weber, who had hoped to orchestrate the CEO succession in 2o2o, fire the starting shot on UBS's update this year, and then exit himself in 2022, this delicate impasse is an expensive self-own. He knew Hamers well from the IIF, a banking trade body, he presides the UBS board committee devoted to succession, and he set into motion the replacement which now paralyzes UBS.

While people close to UBS are keen to point out that none of the facts surrounding the ING case have changed, Hamers exiting almost as quickly as he arrived would imperil the very modernization he was hired for, which in turn casts a shadow on Weber’s legacy.

Ex-Finance Minister Probed

Weber had already fumbled the early succession steps, wrong-footing then-CEO Sergio Ermotti will ill-timed comments. A clearer picture of Weber’s handling the Hamers’ hire is now emerging as well: he may have perturbed his board colleagues with somewhat territorial handling.

To be fair, Weber could not have known that Amsterdam would begin taking a far sharper tone against executives in money laundering investigations. Even Gerrit Zalm, an influential former Dutch finance minister-turned-bank boss, has reportedly been ensnared (in Dutch).

Weber has repeatedly cited an outside evaluation of the money laundering scandal which gave Hamers the all-clear, but this review was reportedly mandated by the search firm, not by UBS itself, according to «Tages-Anzeiger» (behind paywall, in German). For UBS, the issue is not of Hamers himself, but whether UBS can withstand the distractions surrounding his leadership.

Diversion Test Of Durability

The CEO of 12 weeks faces investors for the first time for UBS’ fourth-quarter results on Tuesday. He will use the occasion to outline his planned revitalization, according to UBS insiders. How well he can executive on the plan despite the Dutch diversion is a key test of his durability as CEO.

The Swiss bank can ill-afford the distraction: in seven weeks, UBS heads into court in Paris for a long-awaited appeal to a 2019 criminal conviction. The «optics» of its CEO being investigated over money laundering in one country while the Swiss bank tries to rid itself of a costly criminal conviction in another country are almost farcical.

Steady Hands Over Outsiders

As UBS grinds towards the informal mid-year deadline to resolve the Hamers situation, it has two natural in-house candidates: incoming Swiss boss Sabine Keller-Busse and private bank co-head Iqbal Khan. It also has a dark horse in UBS veteran Tom Naratil, who is viewed favorably for his unparalleled institutional knowledge of the Swiss bank.

This makes the 59-year-old American a safe stopgap who won’t threaten or alienate top talents like Keller-Busse or Khan. Outside candidates like Jean-Pierre Mustier, most recently of Unicredit, or even a return of ex-investment bank head Andrea Orcel, currently in the running to replace Mustier at the Italian bank, are less likely, according to a person familiar with the process: UBS would want to signal stability if Hamers left the job.

Peter Hody contributed reporting