Collardi: Light vs Shadows

Hodler is staking his claim to the bank's next chapter – a new wrinkle given that Julius Baer has lots of boxes left to tick despite Collardi's undisputedly impressive output. To be sure, the legacy of Swiss banking's biggest star of the moment is one of both light and shadows.

Take Julius Baer's home market, for example: the bank has an excellent reputation in Switzerland, but a modest market share. This seems to be linked not just to management's attention to far-flung, glamorous offices in Singapore or Dubai, but also the belief that Julius Baer sniffs at clients with less than 10 million Swiss francs.

Hodler has identified Switzerland, led by Collardi associate Gian Rossi (pictured above), as a priority – including banishing what he views as an erroneous perception that the bank is only after the ultra-rich, he has told staff.

Formula E Charm

How? The bank wants to make a huge splash in June, with Switzerland's first motor-racing event in 64 years. The bank is the circuit's main sponsor, thanks to Collardi's contacts to Alejando Agag, the Spanish ex-politician who founded Formula E. The electric-powered circuit is a huge hit in Asia, and the bank could win a boost if the enthusiasm carries over into its home market.

Julius Baer is riding the zeitgeist: electric cars like those raced by Swiss driver Sebastien Buemi (like many converts to electric racing, he is used to compete in Formula 1) fit with a shift away from noisy, pollutive engine-powered races to a more sustainable form of sport.

Hodler has also drilled the troops to hammer home the «pure player» aspect of Julius Baer, meaning it doesn't offer any investment banking products that would dilute its brand as a traditional, white-glove private bank. For Hodler, the emphasis on private banking alone is a key shift from Collardi, who was more flexible in adapting the bank's strategy to whatever opportunities arose.

Asia Braces

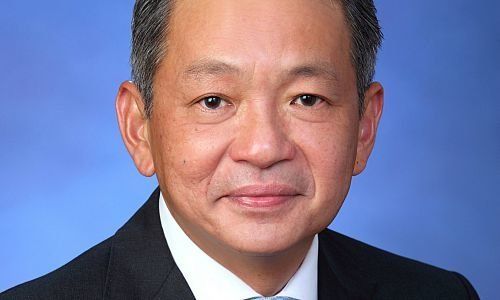

Investors should also look for a clear positioning from Julius Baer in Asia, where the bank is most vulnerable to Collardi picking off clients and their assets. Under Asia head Jimmy Lee (pictured below), the bank is bracing for a showdown: «We will do all our homework before he [Collardi] joins [Pictet] and really really make sure we are relevant to clients, which keeps us on our toes» the 55-year-old banker said last month.

If Asia should be Hodler's chief worry, just as much work awaits him in Luxembourg, where Julius Baer is morphing a branch acquired from Commerzbank more than two years ago for its European Union hub. Another hot spot is Italy, where the bank recently fully acquired Milan-based wealth manager Kairos Capital despite previous avowals to list a minority stake.

Golden Italian Deals

The driving force behind the acquisition, which began nearly five years ago? Collardi, who ensured the Kairos founders and partners a golden handout. Investors are watching whether founder Paolo Basilico and other key Kairos bankers will remain on board without their benefactor.

All told, Hodler's first task is to ensure stability – regardless in Switzerland, Asia, or Italy. This priority highlights the role of Julius Baer's board, a jumble of disparate representatives who rarely asserted themselves publicly when the publicity-savvy Collardi was running the bank.

Chairman Daniel Sauter (pictured above), an ex-commodities banker, was more than happy to cede the limelight – and with it considerable freedom – to the far younger and glamorous CEO, as finews.asia has previously written. With Hodler, a diligent and more strait-laced CEO without the allures of his predecessor, Julius Baer's board is also in focus as the bank rolls out its 2020 strategy.

- << Back

- Page 2 of 2