The smallest of Singapore's big-three banks reported an almost 10 percent rise in net profit, fueled by more fees and commissions from wealthy clients.

Singapore's United Overseas Bank (UOB) said profit last year stood at S$3.4 billion, up from S$3.1 billion a year earlier. UOB said it will pay shareholders a dividend of S$0.45 cents per ordinary share, and a special dividend of 20 cents.

Together with the interim dividend of S$0.35 cents, the core dividend for 2017 amounts to 80 cents per ordinary share, an increase of 14 percent over 2016.

Wealth Fees Rise

Like fellow big-three lenders DBS and OCBC, UOB took a series of provisions against bad loans in the third quarter. The bank's allowances for dud loans and other assets increased 49 percent to S$1.48 billion, mainly from non-performing assets in the oil and gas and shipping sectors, the bank said in a statement on Wednesday.

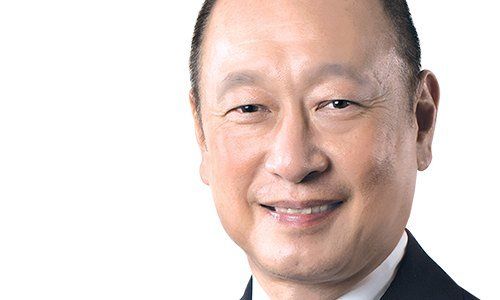

«With the improving outlook across the region, our customers are stepping up on their regional expansion plans and expect further growth in their personal wealth,» CEO Wee Ee Cheong said.

Wealth Management Fees

Fees from wealth management grew 36 percent to S$547 million, up from S$403 million last year driven by higher sales of treasury products and unit trusts. Assets under management for 2017, which comprises both the mass affluent units and the private bank hit S$104 billion.

The bank's private banking arm is dwarfed by industry giants like UBS, but domestic banks including UOB have made inroads with wealthy clientele seeking a local touch.