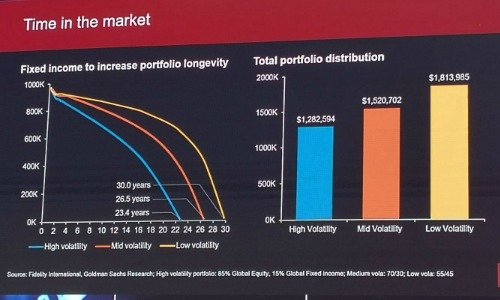

«Imagine you are taking a career break, or you are retiring. You accumulated $1 million. The three curves show different portfolio longevity,» shared Froehlich during the conference (pictured below).

Source: Fidelity International, Goldman Sachs Research

High Volatility Portfolio Comprises 85% Global Equity, 15% Fixed Income

Low Volatility Portfolio Comprises 55% Global Equity, 45% Fixed Income

Liquidity Solutions

To make the asset class more liquid for investors, Fidelity has put in place infrastructure for a liquidity solution with a T+1 settlement cycle, over the last 12 months.

While building it took his team only six months to develop the infrastructure, changing the mindset of stakeholders and clients to take up the new solution took about 12 months.

Mindsets Shifting

In a similar vein, the takeup of tokens or digital assets backed by fixed income has been slow due to a lack of infrastructure, and the stickiness of an old mindset. However, the mechanics can be quite simple, explains Froehlich.

«Step number 1, you put on the blockchain the information of the company. Step number 2, you code a smart contract the terms of the bond. Step number 3, you issue those token to your investors, and they have a digital representation of the bond.»

Exciting Times Ahead

Nevertheless, Froehlich believes that exciting times are ahead for the fixed income asset class with the rise of blockchain technologies.

«When it comes to fixed income applications, we’re only scratching the surface. I love this asset class, this asset class is about to become more exciting, especially for the retail investor,» he said.

- << Back

- Page 2 of 2