A swath of Swiss wealth managers boasted a recovery of their margins last year. The pandemic is about to wipe some of that out.

No sooner had wealth managers in Switzerland finally reset after the global financial crisis of 2008-09 than the coronavirus crisis hit, as finews.asia wrote in August. Private banks are in the eye of the storm – deceptively calm, but fearful of the fallout.

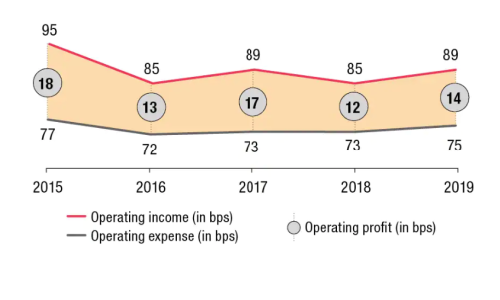

That's the conclusion from a report by PwC. Banks are suffering from vanishing margins – not a new phenomenon (they hit an all-time low in 2018) (see graph below).

Revenue Climb

While the situation improved slightly last year, market conditions won't change much for private banks. They will need to dramatically cut costs, as McKinsey's Jan Quensel told finews.asia two months ago: «As assets under management corrected over the past months, costs have become more important. The costs at the front are a significant issue, having increased the most over the past three to four years with almost 3 percent.»

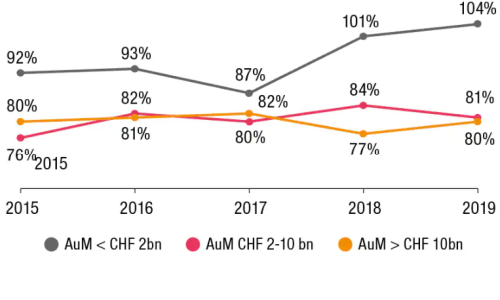

Shirking Spending Cuts

Quensel's advice is to keep cutting. «We believe in a front-to-back cut in costs along the main process lines of a bank, supported by a reduction in complexity, for instance in the areas of markets and products,» the McKinsey associate partner in Zurich said.

In short, a radical spending structure, but it is precisely small private banks that shirk this, according to PwC (see graph below).

Specifically, it means that many Swiss private banks with less than $2 billion are spending an average of 1.04 Swiss francs for every franc in revenue they take in. These small firms, PwC concludes, lack the size to remain competitive.

By contrast, mid-sized and larger private banks managed to steady their cost-income ratios in recent years, albeit at a bloated 80 percent.