When UBS took over Credit Suisse, it was primarily eyeing its wealth management business. But that unit of prime tenderloin now looks considerably less appetizing.

For those hoping for an international «wealth management powerhouse» from the combined UBS/CS, Monday's quarterly figures from Credit Suisse likely feel like a wet blanket.

As reported by finews.asia, its wealth management business saw clients take 47.1 billion francs ($52.8 billion) elsewhere between January and March, with the Swiss home market also affected. Its fund business saw a further outflow of 11.6 billion francs.

Lofty Ambitions

Worse still, the outflows decreased further during the fateful days around March 19, with the outflows continuing unabated. The decline will continue to be felt, with the bank expecting a decline in net interest income and recurring commission and fee income due to a lower deposit and managed asset base.

That will result in a significant wealth management loss in the second quarter, according to Credit Suisse.

Losing Ground

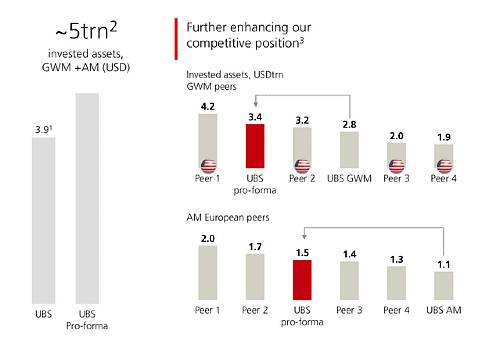

UBS is losing ground in the Credit Suisse division most valuable to the buyer. UBS chairman Colm Kelleher held out the prospect of a five trillion dollar behemoth in private banking and asset management to shareholders from the takeover.

This would create the world's second-largest wealth management force and Europe's third-largest fund house, UBS executives told investors on March 19 (chart below).

(Image: UBS)

By comparison, UBS had invested assets of $3.9 trillion at the end of last year.

Clarity on Personnel

Now UBS is getting this supposedly prime cut of Credit Suisse served burnt. Last quarter Credit Suisse took an impairment charge on its wealth management division, writing down the division's goodwill by 1.3 billion francs to zero as a result of billions of francs in client money outflows.

While Credit Suisse promised «proactive measures» to protect its client business, as the buyer, UBS has to watch how this decline in wealth management develops, even before the takeover has been formally completed.

UBS presents its quarterly results tomorrow, and there is a heightened sense of urgency to counter these outflows. This could be achieved if it provides clarity on personnel. Numerous Credit Suisse teams remain in a holding pattern so long as it is unclear who will assume the leadership mantle and what their professional future at UBS/CS will look like.

UBS CEO Sergio Ermotti said every employee of the combined bank will be treated equally, extending the uncertainty to employees of the acquirer bank.

Dwindling Margins

Purely on paper, UBS benefits from acquiring Credit Suisse for three billion francs, an enormous discount to the market value of 7.4 billion francs at the time of the takeover. Analysts from JP Morgan recently calculated UBS still would not have paid too much even if Credit Suisse lost half of all client assets in wealth management, the fund business, and the Swiss bank.

That sounds like a wide margin, but after total assets under management fell 19 percent year-on-year in the first quarter, it also already shrunk significantly.