The private equity boom is likely to slow down. However, some countries and sectors are still very much in the focus of investors.

With interest rates stuck at record lows for years, investors needed alternatives to the traditional asset classes. With investments in private equity funds, they were able to generate the returns not available anywhere else.

The private equity industry thus profited from this dearth of alternatives and received large inflows of money.

2018 Sees Begin of Slowdown

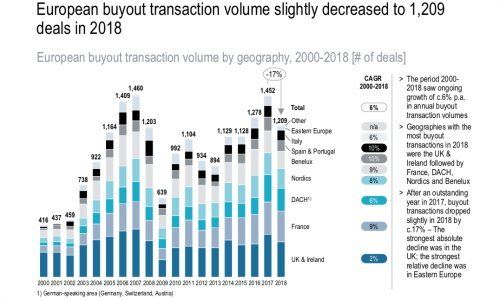

The growth of this business also led to an increase in the number of transactions triggered by the funds – until recently that is. Last year saw a decline in transactions in Europe (see table below), according to a study presented by Roland Berger consultants.

The participants of the survey were fairly pessimistic about the outlook for this year, with about half of them expecting a further slowdown.

One of the reasons behind the pessimism is a dearth of buying opportunities following the spending spree of recent years. Private equity firms simply are fighting over fewer targets.

Smaller Firms Remain Attractive

Investors also have become more selective in terms of the industries they target. Construction, a sector strongly exposed to the swings of the economy, has become less attractive, while the pharmaceuticals and tech industries remain priorities.

The focus of the buyers is on small and medium-sized firms, which should give M&A bankers in Switzerland some respite. The level of interest to make investments in Swiss firms remains on a good level, said Ralph Mair, an expert at Roland Berger. One of the reasons is the structure of the economy with its heavy emphasis on small- and medium-sized companies.