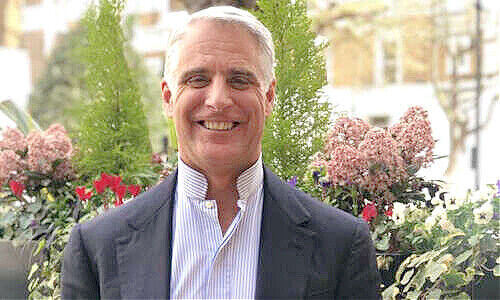

The Italian bank wants Andrea Orcel as its new CEO. The 57-year-old investment banker still needs to resolve two weighty issues first.

After 28 months away from the C-suite, Andrea Orcel is going to be CEO: the board of Italy's Unicredit unanimously backed him to succeed current CEO Jean Pierre Mustier, the Italian bank said in a statement. Mustier leaves Unicredit after fourth-quarter results, due February 11.

Orcel, until September 2018 the top investment banker at UBS, still needs to settle a 112 million euro ($136 million) fight with Santander. The Spanish bank had reversed its decision to name him CEO and instead dumped him unceremoniously, and Orcel sued.

Unicredit, UBS In Peer Group

UBS also needs to resolve the issue of more than $50 million in long-term awards still stowed at UBS, subject to restrictions if the veteran Italian rainmaker takes an executive job with a competitor. In reality, this can be subject to interpretation – as well as apparently negotiation.

To be sure, Unicredit – like UBS – is a systemically relevant bank and thus a peer, just as other internationally active universal banks in Europe, the U.S., Japan, and China are.

The Unicredit appointment ends a 28-month nomadic period for the impeccably connected Italian dealmaker, who spent his time advising as well as pursuing the Santander case. UBS' ultimately unsuccessful wrangling to keep Orcel was on full display in the unprecedented saga.

Running Afoul Of Italy

Mustier, a French banker, threw in the towel last month after reportedly running afoul of the Italian government for bucking their wish for Unicredit to buy Monte dei Paschi di Siena, among other things. Orcel will run into the same conundrum shortly into his tenure.

Ironically, Orcel orchestrated Monte dei Paschi's 2007 acquisition of Antonveneta, a deal that has hounded the Siena-based bank since. Though Orcel spent the bulk of his career in London with Merrill Lynch, he also pitched a merger of Unicredito and Credito Italiano – the very deal that created what would become Unicredit.